Q&A Interview

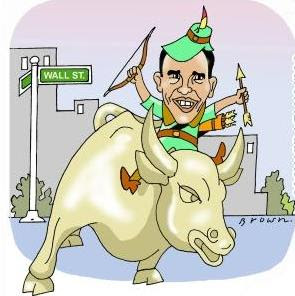

Paul Holmes discusses the economy with Mainfreight Ltd [MFT.NZ] managing director Don Braid,

Far North Mayor Wayne Brown and Economist Shamabil Yarkob today on Q & A.

Focus on what Don Braid says about the economy. His experience is that it is growing from exporting and his own company has grown in the last quarter, mainly from poaching market share off competitors.

He emphasizes that businesses that are surviving the current recession have done so by cutting back business fat: employees, removing poor business practices, economising where possible and that growth for New Zealand is going to be long and hard - something I have been saying for the last two years.

Don quoted this statistic:

From 2004 - 2010 the Public Admin and safety sector increased employment by 20% while the manufacturing, transport and warehousing sector dropped by the same amount.

Too many bureaucrats got us into this recession in the first place and we need to strangle off the clipboard carriers so we can grow businesses and the economy.

I interviewed Don late last year and he is very forthright and straight up with his answers. No bullshit and no bluster.

His take on the economy now and over the coming years I believe is an accurate place on where we are at present.

Disclosure I own MFT shares in the Share Investor Portfolio

Mainfreight @ Share Investor

Mainfreight Ltd: Full Year 2010 Profit Analysis

Long Term View: Mainfreight Ltd

Share Investor Interview: Mainfreight's MD Don Braid

Stock of the Week: Mainfreight Ltd

Questions to Mainfreight's MD Don Braid

I'm Buying: Mainfreight Management delivers the goods

Mainfreight Annual Report Packs a Punch

Analysis - Mainfreight Ltd: FY Profit to 31/03/09

Mainfreight VS KiwiRail: The Sequel

Long VS Short: Mainfreight Ltd

Why did you buy that stock? [Mainfreight Ltd]

Mainfreight 2008 Annual report worth reading

KiwiRail will cost Mainfreight

Mainfreight keeps on truckin

A rare breed

Share Investor's 2008 stock picks

Discuss MFT @ Share Investor Forum

c Share Investor 2010