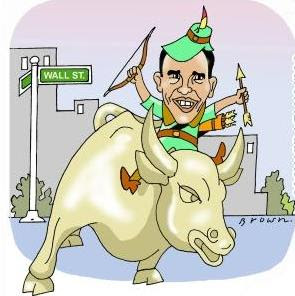

Once again global stockmarkets are rightly nervous about the so-called economic recovery in the United States, with Obama acting like Robin Hood without an arrow and rumblings of credit clampdowns in China, the DOW has lost almost 5% in one week as a result.

Once again global stockmarkets are rightly nervous about the so-called economic recovery in the United States, with Obama acting like Robin Hood without an arrow and rumblings of credit clampdowns in China, the DOW has lost almost 5% in one week as a result.

It is bloody exciting!

I was getting sick of the disconnect between the reality of a debt led "recovery" and the fantasy of investors in stockmarkets like the DOW, who have pushed that particular market up by over 40% in less than a year -incidentally that is the largest bull run since the 1929 Wall Street crash and we know what happened after that particular market "recovery".

Yep 40%, does anyone think we are doing that much better now than we were this time last year?

Not this fellow.

I last bought stocks in July and haven't felt tempted yet until The Warehouse Group [WHS.NZ] shares took a dive recently, simply because some companies are overvalued compared to 12 months ago.

The excitement is building now for me as there looks like reality could have dawned on some and they could be rushing for the exits as I am happily ready to enter the market again at a better price.

One the economic outlook, there is anecdotal evidence on my part - I tend to trust that more accurately than what economic soothsayers are being paid to say - that the economy in New Zealand, while not completely buggered, is still hanging on a knife edge between growth and recession and it appears that any growth is going to be sporadic and a long time coming.

There just isn't any money out there.

A good time to buy assets if you do have some moola and the NZX is likely to take its lead from the US market where it dropped by over 200 points last Friday.

Happy buying.

Recent Share Investor Reading

- Reason to be cautious on Nuplex forecast

- Cadbury Aquisition a good deal for Kraft

- Stock of the Week - Reprise : The Warehouse Group

- Bitter - Sweet Chocolate Business

- Share Investor's 2010 Stock Picks

- BOOK REVIEW: Warren Buffett on Business

Related Amazon Reading

The Great Depression : Delayed Recovery and Economic Change in America, 1929-1939 (Studies in Economic History and Policy : The United States in The) by Michael A. Bernstein

Buy new: $26.93 / Used from: $22.88

Usually ships in 24 hours

The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Counsel (Revised Edition) by Benjamin Graham

Buy new: $12.86 / Used from: $7.92

Usually ships in 24 hours

c Share Investor 2010

What do you mean by "There is no money out there" ?

ReplyDeleteHey SB, good question.

ReplyDeleteMy anecdotal "survey" of those that I know either intimately, in business or casual acquaintances, all profess to be shutting up their wallets. They come from a wide variety of backgrounds from low income earners to multi millionaires.

Why are they shutting their wallets?

I suspect and I know of a few examples of those that I outlined above have been overcome by their debts levels AND or they have less money coming in.

It is by no means a completely accurate reading of the economy and could well be horribly wrong based on just those I know, but as I said in the post I think it is more accurate than economists collective and individual stabs in the dark, which are largely based on guesswork - just like mine!

Theirs just looks at figures AFTER they come out and then they all speculate as to what is "going to happen."

Ergo my expression that you so rightly questioned.

Many of the people I know, either are swimming in cash/funds in stocks. Or never really had any money to start with.

ReplyDeleteBut my circles would be quite different to yours.

I think who I know are representative of those at the top and at the bottom, excluding those at the very bottom and those very wealthy - worth NZ$15 million plus.

ReplyDeleteI would say those middle classes, such as myself, would have a similar mix of people to myself from which to draw their own conclusions.

How about you ShortBus are you a swimmer or a sinker?

ReplyDeleteYeah SB, I would like to know what you think about the state of the economy.

ReplyDeleteI am a swimmer Anon. I find the current situation provides an opportunity to buy cheaper assets. I do believe though that any consistent recovery from this recession is going to take years.

Darren: I do not think that "Anonymous" was asking about the economy, but rather the state of my cash in terms of swimming in it. To which the answer is "No comment".

ReplyDeleteAs for the economy, I do not hold much hope for a true recovery in the short term, but I am no economist of great measure and can only really go with the trends, and follow the advice of those more educated in these things than I, like Marc Faber.

I am expecting new lows in stock markets and I am expecting several blowups of countries around the world in the coming years. There are several countries which have such bad fundamentals. If my finances were as bad as some of these countries I would be very worried.

Indeed, I was interested in your take on the economy in general and the prospect for its recovery.

ReplyDeleteI am still of the opinion, and I have held it since Sept 2008, that we are in for a long bumpy ride.