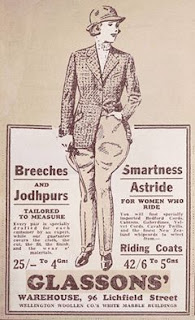

Hallensteins Glassons - HLG.

You know it's a well run company - I'd say the best company of its type anywhere in Australasia.

It does not have any debt and has cash in the bank. Whatever challenge it faced up to in its over 140 years of existence it has overcome that. Covid 19 will be no different.

In the area it operates in one thing is clear. The weaker competition is falling - including the recent influx of overseas brands.

Once a couple of these have got the tail between their legs and scuppered, from this part of the world or entirely - they all hold far too much debt. Hallensteins will be there to mop up the peices AND have far less competition!!

So Hallensteins will be planning right now to change, just how much change is up to conjecture but they will probably change anyway. Their online store is just one feature. The only change down at Hallensteins HQ will the fact that Covid 19 is just another one of those changes of a long list they been through before.

One thing I constantly am appalled about and that is the comparions made between the economic fallout from Covid 19 and the Great Depression. It is by no means as serious as the Great Depression and is not likely to be unless something goes horribly wrong - that whole Great Depression/Recession thing annoys me. We have got a long way to go before we stoop to the depths of depravity those poor souls had to suffer - So Hallensteins passed the Great Depression.

Hallensteins will come out of this - Covid19 - in the same way. The way they have come out of the rest of the calamities than have befallen them. With a new approach to doing business.

For without that new approach combined with the old fashioned attitude towards debt Hallensteins Glassons Group would be yesterdays toast.

Hallensteins will come out of this - Covid19 - in the same way. The way they have come out of the rest of the calamities than have befallen them. With a new approach to doing business.

For without that new approach combined with the old fashioned attitude towards debt Hallensteins Glassons Group would be yesterdays toast.

Now im no expert at share prices. I just know a great company when i see one. This little puppy plumbed the depths of about $1.80c just a couple of weeks ago. Right now its up on hope - its doubled in price to about $3.60c - hope that things will get started again - soon.

You could buy today or take your chances and buy on the bad news. Because there is more bad news - none moreso than any other stock on the nzx.com - to come with this stock.

DYOR.

Hallenstein Glasson @ Share Investor

Hallenstein Glasson: Buy

Hallenstein Glasson: What Do I Do?

Hallenstein Glasson: Sold By Days End?

Share Price Alert: Hallenstein Glasson Holdings Ltd 3

Share Price Alert: Hallenstein Glasson Holdings Ltd 2

Share Price Alert: Hallenstein Glasson Holdings Ltd

Hallenstein Glassons Ltd: Should I stay or should I Go?

Mixed Retail Outlook

Long Term View: Hallenstein Glasson Holdings Ltd

The History Of: Hallenstein Glasson Holdings Ltd

Hallenstein Guidance not indicative of wider retail recovery

Stock of the Week: Hallenstein Glasson

Hallenstein Glasson Australian expansion needs expert execution

Why did you buy that stock? [Hallenstein Glasson]

Discuss HLG @ Share Investor Group

c Share Investor 2020