Every good saga deserves a sequel, Star Wars, Indiana Jones, The Godfather, you get the idea.

Every good saga deserves a sequel, Star Wars, Indiana Jones, The Godfather, you get the idea.

Well this is the sequel to yesterdays first installment Paul Carruthers Goes Feral...Again.

Yesterday I was the main character who was taking moola from some mysterious benefactor to write my opinions on the Allan Hubbard Saga. Today though in Going Feral - Part 2, along with the payola implications are stories that I am a terrorist out to get my prey and there is a mysterious Russian after me.

I cant wait for part 3, Going Feral: The Wrath of Carruthers?

It is not a full moon, as far as I know, and neither is it a date with 3 sixes in it but I received an interesting reply this morning to a facebook exchange on an Allan Hubbard supporters page from one of the main ring leaders of the support group, Michelle Helliwell. She looks to be Paul Carruthers - the head spokesman for Allan Hubbard - right hand woman and seems to be taking her lead from him in terms of his feral like public relations style.

Of course little of what Michelle says below is even moderately close to any truth and some of it is indeed more than slightly paranoid, threatening and even a little creepy.

I mean, Russians under the bed somewhere ready to make a move on me.? Well, it would be an exciting escape from changing nappies on my 15 month old but I will stick to the crap from an infant rather than that hurled at me from a big grownup thanks very much mam.

On Allan Hubbard and his fate, there is a 5th Grant Thornton report due out at the end of November related to the statutory management of multiple failed Hubbard investment vehicles and a Serious Fraud investigation into the collapsed South Canterbury Finance, that lost almost $2 billion and was bailed out by the taxpayer.

The SFO investigation will be a long one as paperwork and crucial records are either missing or were not there from the get go and the complicated related inter-party lending on top of this makes for a mess only equaled by Mr Hubbard's fraudulent behavior.

We should see some information dribble out from the SFO case before Christmas.

Stay tuned!

It has come to our attention that you are responsible for the hateful Allan Hubbard page. You are a toxic terrorist on the support pages... and you are not welcome. Please go away.

On a positive note, I will thank you for making it so ob...vious internationally how much you hate Allan Hubbard (for no good reason other than Darren Rickard being on 'you know who' payroll). The battle between 'good' and 'evil' is becoming increasingly obvious.

Your attempts to slash Allans credibility in NZ has drawn attention from thousands that know Allan Hubbard internationally and you have made it so obvious how abhorrent you are by your bile.

Your attacks against Allan Hubbard are, and always have been, unjustifiably vicious. Your refusal to show your face in person is cowardly. You rip up the reputation of a man who doesn't own a computer on the internet... not very brave!

Allan Hubbard is incapable of dishonesty or fraud like no other person you have EVER met. Only an idiot would say otherwise. Your posts are imagination. Nearly all respect him and most love him.

By the way, I was asked about you in Auckland last weekend Darren. You have made a most unpopular impression on a certain Russian. We all suggest you voluntarily leave this page.

God bless, and goodbye.

Michelle, if you could give me Allan's contact details, I would only be too glad to let him have his say right here on this blog. It is an open invitation with no restrictions on what he wants to say.

A question and answer session would give him a right of reply to some of the things I and others have been writing about him.

Related Share Investor Reading

Full SFO Statement on SCF Fraud Investigation

Download Grant Thornton Report 1Download Grant Thornton Report 2

Download Grant Thornton Report 3

Download Grant Thornton Report 4

Allan Hubbard Saga: Paul Carruthers Goes Feral... Again

Allan Hubbard: The Biography

Allan Hubbard Saga: On Forged Signatures and Uncharitable Trusts

Allan Hubbard Saga: Evidence of Fraud now Clear

Allan Hubbard Saga: NBR VS the SFO

Allan Hubbard Saga: South Canterbury Finance to be investigated by the SFO

Allan Hubbard Saga: Third Grant Thornton Report

Allan Hubbard Saga: Will He Walk?

Allan Hubbard Saga: No Longer Bothered by Botherway

Allan Hubbard Saga: 60 Minutes Interview, Sept 23 2010

Allan Hubbard Saga: Supporters head to the exit door

Allan Hubbard Saga: Threats & the Mysterious PWC Report

Allan Hubbard Supporters: Conflict of Interest

VW Veneer reveals BMW heart

VIDEO: Jenni McManus Explains Allan Hubbard Collapse

Allan Hubbard Statement on SCF Receivership

VIDEO: Sandy Maier - full news conference on SCF Receivership

Market Alert: South Canterbury Finance to be placed in Receivership

Allan Hubbard: Ignorant Supporters Blissfully Unaware

Thornton Report 2: Allan Hubbard Guilty as Charged

Allan Hubbard: Full TV3 Interview - July 16 2010

Thornton Report 1: Allan Hubbard's Aorangi Securities

Bothered by Simon Botherway

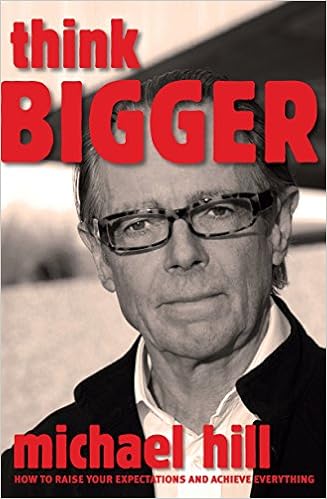

New From Fishpond.co.nz

c Share Investor 2010