We are all only to well aware that the New Zealand Kiwifruit industry is undergoing immense pressure from the kiwifruit vine disease PSA.

The listed kiwifruit and avocado marketing company Seeka Kiwifruit Industries Ltd [SEK.NZX] is also under pressure from this disease and its share price has dropped by around 30% since the news broke.

The stock is thinly traded so any news will move the share price wildly but the big drop presents an opportunity for investors to get in while the shares look cheap.

The company has tangible assets of $3.83 per share (valuation pre bad news) so on face value the company is now going cheap.

Just like the BP disaster a few months back it allowed investors to get into a good company with good prospects for a great price.

I am not saying this is going to be a low for the share price because there could be more bad news to come and Seeka have provided a market update with another due at the end of November, but it is worth considering taking a closer look should the valuation of Seeka meet your investment criteria.

Buy on further weakness.

Seeka @ Share Investor

Discuss SEK @ Share Investor Forum

Download SEK Company Reports

New From Fishpond.co.nz

Allan Hubbard: Man Out of Time - By Virginia Green

c Share Investor 2010

Friday, November 19, 2010

Seeka Kiwifruit Industries Ltd: Opportunity for Investors

Posted by Share Investor at 9:15 AM 2 comments

Labels: Seeka Kiwifruit Industries Ltd, SEK

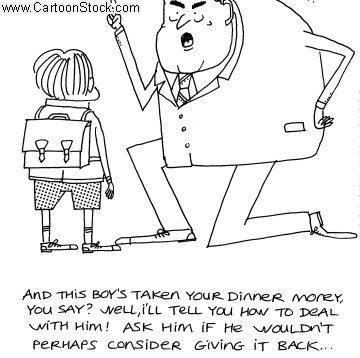

Allied Farmers Ltd: You said what Rob?

CEO of Allied Farmers Ltd [ALF.NZX] Rob Alloway, has decided, now that the shite has hit the fan again with another "asset" inherited from the Hanover purchase going tits up, that the blame for the parlous position he and his company and its long suffering investors find themselves in is because Messrs Hotchin and Watson from Hanover overvalued the assets that the company had on its books at the time of the merger of Allied Farmers and Hanover back in late 2009:

CEO of Allied Farmers Ltd [ALF.NZX] Rob Alloway, has decided, now that the shite has hit the fan again with another "asset" inherited from the Hanover purchase going tits up, that the blame for the parlous position he and his company and its long suffering investors find themselves in is because Messrs Hotchin and Watson from Hanover overvalued the assets that the company had on its books at the time of the merger of Allied Farmers and Hanover back in late 2009:

Mr Alloway said the value of Matarangi provided in the 30 June 2009 accounts, used by investors to inform the eventually successful vote to merge, was "unrealistic".

Mr Alloway didn't pull any punches in his statement, and said the state of Matarangi was symptomatic of many former Hanover assets:

“This is an unfortunate trend we have seen with most of the property and loan assets that were acquired, and further calls into question the real value of the shareholder support package contributed by Messrs Hotchin and Watson at the time of the Hanover moratorium. The investment community should have expected far better oversight of the moratorium from Hanovers directors, valuers, trustees and auditors.” NBR, 18 November 2010Back in November 2009 (almost 1 year to this day) though Mr Alloway was singing from a different song sheet with the will of a man who had crossed all his Is, dotted his Ts and had the champagne on ice:

"We've left behind all the problems ... this is goodbye Hanover, Mark and Eric.

We've got all the assets and anything that's worth anything and said goodbye to the rest, they can deal with the problems. Any litigation or exposure they have is theirs." NZ Herald November 21 2009.

Alloway was also confident that Allied was more able to recover Hanover's bad loans than they were and we all know that was about as successful as Bernie Madoff would be at making a comeback as an investment adviser.

I posed this question back in April and then June, why are Alloway and his fellow directors at Allied not being prosecuted for a fraudulent prospectus? Fraudulent because the prospectus contained overvalued assets on the balance sheet that Hanover and Allied investors based their decision on to vote for the two companies to merge.

An unfortunate choice of words.

What the ***k is he now saying?

He knows now what he should have known back in 2009 but is blaming Hanover for the mess Allied is now in?

It is called due diligence Rob, you didn't do it properly pre-merger and now you are trying to cop out of the blame that lies on you and your fellow directors at Allied.

At the very least put your hand up and do the right thing and take some responsibility.

Allied Farmers @ Share Investor

Long Term View: Allied Farmers Ltd

Allied Farmers: Rights Issue Decision

Allied Farmers: Prosecutions should be on the cards

Allied Farmers Fraud passes with little fanfare

Allied Farmers: What's it Worth?

Hanover, Allied Farmers deal more of the same

Discuss ALF @ Share Investor Forum

Download ALF Company Reports

Recommended Fishpond Reading

Buy The Intelligent Investor & more @ Fishpond.co.nz

c Share Investor 2010

Posted by Share Investor at 12:01 AM 0 comments

Labels: ALF, Allied Farmers, Rob Alloway

Thursday, November 18, 2010

Ryman Healthcare Ltd: 2011 Half Year Profit Review

Ryman Healthcare Ltd [RYM.NZX] 2011 first half year to 30 Sept 2010 is another stellar result for the retirement village operator. Profit is up 25% to $36.1 million on last years corresponding period.

Ryman Healthcare Ltd [RYM.NZX] 2011 first half year to 30 Sept 2010 is another stellar result for the retirement village operator. Profit is up 25% to $36.1 million on last years corresponding period.

This is on revenue up 23% to $104.5 million.

Management have indicated that expansion during the 2010 financial year has contributed to the record result but clearly costs have been kept low because profit has outstripped revenue.

Management have also indicated they are on track for another 15% boost to profit over the 2011 fully year. This level of growth has been consistent for the company for as long as it has been a publicly listed company.

Key Points

Net Profit:

$36,119,000

Fair value movement of investment properties:

$41,995,000

Total Income:

$104,594,000

Earnings per share:

10.4 cps; 35%; 7.7 cps

Interim Dividend :

3.4 cps; 26%; 2.7 cps

Over 300 units added

15% profit growth tipped for 2011 full year

I have little reservation in my shareholding in this company and consider management have been exceptional in their handling of the business over the last 12 months. A period of uncertainty with, restrained economic growth.

I am only sorry I didnt buy more shares when the stock was trading a dollar lowers during the last year or so.

Disclosure: I own RYM shares in the Share Investor Portfolio

Ryman Healthcare @ Share Investor

Gordon Macleod on Ryman Healthcare's Australian Expansion

Share Investor Q & A: Ryman Healthcare's CFO Gordon MacLeod

Ryman Healthcare: Interview sneak peak

Ryman Healthcare Ltd: Australian Expansion Needs Care

Share Investor Q & A: Reader Questions to Ryman CFO Gordon Macleod

Long Term View: Ryman Healthcare Ltd

Stock of the Week: Ryman Healthcare Ltd

Why did you buy that stock? [Ryman Healthcare]

Long VS Short: Ryman Healthcare Ltd

Time for retirement?

Discuss RYM @ Share Investor Forum

Download RYM Company Reports

New From Fishpond.co.nz

Allan Hubbard: Man Out of Time - By Virginia Green

c Share Investor 2010

Posted by Share Investor at 9:15 AM 0 comments

Wednesday, November 17, 2010

Allan Hubbard Saga: VIDEO - Hubbard Biographer Virginia Green on TVNZ Breakfast

The author Virginia Green has been shopping her Allan Hubbard Bio, Allan Hubbard: Man Out of Time around the traps this week and this morning stopped at TVNZ's Breakfast to give her view of the Hubster.

She is asked about whether the book is an authorised biography or unauthorised but dodges the question by answering a question not asked. The book was indeed authorised by Mr Hubbard and he worked closely with Virginia on the book, especially the last few chapters on the collapse of his business empire.

In this interview when asked who was to blame for the collapse of South Canterbury Finance (SCF) Virginia places no blame on him, instead poking the finger at the Government and advisors to Hubbard.

She also repeats the often much quoted "rescue package" that was allegdly in place just days before the collapse of SCF.

This deal may have been stitched up but it involved recapitalizing SCF and included money from the taxpayer. These kinds of deals have been put forward multiple times over the last few years in relation to collapsed finance companies and none of them have been successful, in fact they have all led to further loses for investors. The most notable failure being the Hanover/Allied Farmers recapitalisation at the end of 2009.

There was therefore no reason to believe that SCF rescue package would be different to any other that had gone before and indeed it had the potential to risk even more taxpayer money had SCF not been put into receivership by the Government.

Virginia is following the line of Allan Hubbard supporters that dear old Mr Hubbard was a victim of circumstance and fell at the hands of others.

I hope the whole book isn't like that.

I now have the bio to read, courtesy of Sarah Thornton from publisher, Random House, so I will give you an opinion after I trudge my way through it over the next week or so.

Related Share Investor Reading

Full SFO Statement on SCF Fraud Investigation

Download Grant Thornton Report 1Download Grant Thornton Report 2

Download Grant Thornton Report 3

Download Grant Thornton Report 4

Join the Put Allan Hubbard Away Facebook Group

Book Extract - Allan Hubbard: Man Out of Time

Allan Hubbard Saga: Going Feral - Part 3, The Final Cut

Allan Hubbard Saga: Going Feral - Part 2

Allan Hubbard Saga: Paul Carruthers Goes Feral... Again

Allan Hubbard: The Biography

Allan Hubbard Saga: On Forged Signatures and Uncharitable Trusts

Allan Hubbard Saga: Evidence of Fraud now Clear

Allan Hubbard Saga: NBR VS the SFO

Allan Hubbard Saga: South Canterbury Finance to be investigated by the SFO

Allan Hubbard Saga: Third Grant Thornton Report

Allan Hubbard Saga: Will He Walk?

Allan Hubbard Saga: No Longer Bothered by Botherway

Allan Hubbard Saga: 60 Minutes Interview, Sept 23 2010

Allan Hubbard Saga: Supporters head to the exit door

Allan Hubbard Saga: Threats & the Mysterious PWC Report

Allan Hubbard Supporters: Conflict of Interest

VW Veneer reveals BMW heart

VIDEO: Jenni McManus Explains Allan Hubbard Collapse

Allan Hubbard Statement on SCF Receivership

VIDEO: Sandy Maier - full news conference on SCF Receivership

Market Alert: South Canterbury Finance to be placed in Receivership

Allan Hubbard: Ignorant Supporters Blissfully Unaware

Thornton Report 2: Allan Hubbard Guilty as Charged

Allan Hubbard: Full TV3 Interview - July 16 2010

Thornton Report 1: Allan Hubbard's Aorangi Securities

Bothered by Simon Botherway

New From Fishpond.co.nz

Allan Hubbard: Man Out of Time - By Virginia Green

c Share Investor 2010

Posted by Share Investor at 4:06 PM 0 comments

Labels: Allan Hubbard, Allan Hubbard Biography, Virginia Green