Wednesday, December 9, 2020

Trevor Mallard: We just want him to go

Posted by Share Investor at 3:44 AM 0 comments

Labels: false rape, Trevor Mallard

Friday, October 16, 2020

Mainfreight: $100 dollars and up

Mainfreight @ Share Investor

Is Mainfreight Worth 30 Bucks a Share?

Is Mainfreight Worth 20 Bucks Plus a Share?

Share Price Alert: Mainfreight Ltd 2

Mainfreight's European Acquisition a Good Move

Share Price Alert: Mainfreight Ltd

Investing in the Stockmarket: Timing your Purchase

Stock of the Week: Mainfreight Ltd

Mainfreight Ltd: 2011 1st quarter Profit Analysis

VIDEO: Don Braid with Paul Homes on the Economy

Mainfreight Ltd: Full Year 2010 Profit Analysis

Long Term View: Mainfreight Ltd

Share Investor Interview: Mainfreight's MD Don Braid

Stock of the Week: Mainfreight Ltd

Questions to Mainfreight's MD Don Braid

I'm Buying: Mainfreight Management delivers the goods

Mainfreight Annual Report Packs a Punch

Analysis - Mainfreight Ltd: FY Profit to 31/03/09

Mainfreight VS KiwiRail: The Sequel

Long VS Short: Mainfreight Ltd

Why did you buy that stock? [Mainfreight Ltd]

Mainfreight 2008 Annual report worth reading

KiwiRail will cost Mainfreight

Mainfreight keeps on truckin

A rare breed

Share Investor's 2008 stock picks

Discuss MFT @ Shareinvestor

c Share Investor 2020

Posted by Share Investor at 7:52 PM 0 comments

Labels: mainfreight, MFT

Saturday, October 10, 2020

Contact Energy: Up or down from here?

Share Price Alert: Contact Energy Ltd 7

Share Price Alert: Contact Energy Ltd 6

Share Price Alert: Contact Energy Ltd 5

Contact Energy look set to gain customers

I'm Buying: Contact Energy Ltd

Share Investor Portfolio 2: Value @ 7 July 2011

Share Price Alert: Contact Energy Ltd 4

Share Price Alert: Contact Energy Ltd 3

Share Price Alert: Contact Energy Ltd 2

Share Price Alert: Contact Energy Ltd

Stock of the Week - Reprise 5: Contact Energy Ltd

Origin Energy asset stripping Contact Energy

Stock of the Week - Reprise 4: Contact Energy Ltd

Stock of the Week - Reprise 3: Contact Energy Ltd

Long Term View: Contact Energy Ltd

Stock of the Week: Reprise 2 - Contact Energy

Stock of the Week: Reprise - Contact Energy

Not so fast Davy Boy

Still Watching Contact Energy

Beam me up Davy

Stock of the Week: Contact Energy

MarketWatch: Contact Energy - June 2009

MarketWatch: Contact Energy - Jan 2009

Contact Energy looks bright during dark times

Share Investor's 2009 Stock Picks

Follow the Monopoly Board

Discuss this stock at Share Investor Group

c Share Investor 2020

Posted by Share Investor at 4:00 AM 0 comments

Labels: CEN, Contact Energy

Friday, September 25, 2020

Why Hallensteins has the Advantage over Everyone Else

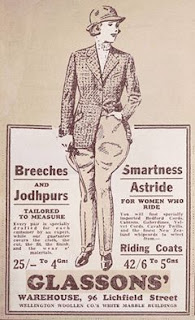

Hallensteins Glassons - HLG.

Hallensteins will come out of this - Covid19 - in the same way. The way they have come out of the rest of the calamities than have befallen them. With a new approach to doing business.

For without that new approach combined with the old fashioned attitude towards debt Hallensteins Glassons Group would be yesterdays toast.

Now im no expert at share prices. I just know a great company when i see one. This little puppy plumbed the depths of about $1.80c just a couple of weeks ago. Right now its up on hope - its doubled in price to about $3.60c - hope that things will get started again - soon.

You could buy today or take your chances and buy on the bad news. Because there is more bad news - none moreso than any other stock on the nzx.com - to come with this stock.

DYOR.

Hallenstein Glasson @ Share Investor

Hallenstein Glasson: Buy

Hallenstein Glasson: What Do I Do?

Hallenstein Glasson: Sold By Days End?

Share Price Alert: Hallenstein Glasson Holdings Ltd 3

Share Price Alert: Hallenstein Glasson Holdings Ltd 2

Share Price Alert: Hallenstein Glasson Holdings Ltd

Hallenstein Glassons Ltd: Should I stay or should I Go?

Mixed Retail Outlook

Long Term View: Hallenstein Glasson Holdings Ltd

The History Of: Hallenstein Glasson Holdings Ltd

Hallenstein Guidance not indicative of wider retail recovery

Stock of the Week: Hallenstein Glasson

Hallenstein Glasson Australian expansion needs expert execution

Why did you buy that stock? [Hallenstein Glasson]

Discuss HLG @ Share Investor Group

c Share Investor 2020

Posted by Share Investor at 7:11 PM 0 comments

Labels: Hallenstein Glasson, HLG

Friday, September 18, 2020

Flying Close to the Sun

Share Price Alert: Air New Zealand Ltd

Queenstown Aiport Case: Air New Zealand VS Auckland

Queenstown Airport: Loud Voices & Loyalty

Long Term View: Air New Zealand Ltd

John Palmer Tipples on the Shareholder

Mike Pero and Air New Zealand: Capitalism vs Socialism

Rob Fyfe's "Environmental Extremism"

Reality Needs to Bite

Air New Zealand wants another taxpayer bailout

Posted by Share Investor at 1:57 AM 0 comments

Labels: Air New Zealand, international airlines

Monday, July 27, 2020

Sky City: Covid-19 The Aftermath

Just as an addendum: I believe you - businesses - have to treat #covid19 as another business. With all its competitive natures currently to the fore. Only then will you begin to spud off new shoots and grow again.

Sky City: Turmoil in Market Brings Bargains

Share Investor's 2016 Stock Picks

Sky City gets the 2nd deal

Sky City Expansion: Adelaide Spreads on the Riverbank

Sky City to pay for National Convention Centre

Share Investor discusses Convention Centre proposal with CEO Nigel Morrison

SKC Convention Centre power-point slide illustrations & SKC submission to Auckland City Council

Sky City Gaming: Morningstars look at Sky City's gaming

Share Investor's Total Returns: Sky City Entertainment Group Ltd

Sky City Entertainment Group Ltd: Presentation to Macquarie Group

Morningstar Revalues Sky City Entertainment Group

Guest Post - Michele Hewitson Interview: Nigel Morrison

Failed Sky City bid for Christchurch Casino good news for Shareholders

Sky City Entertainment Group Ltd: Christchurch Casino bid falls short of Investment Criteria

Sky City Entertainment Group Ltd: Never mind the width feel the volume

Sky City Annual Meeting & 2011 - 2012 Profit Forecast

Stock of the Week: Sky City Entertainment Group Ltd

Sky City set to lose National Convention Centre bid

Sky City Entertainment Group: Australian Acquisition on the Cards?

Sky City Entertainment Group Ltd: 2010 Full Year Profit Analysis

Sky City Entertainment Group 2010 Full Year Profit Preview

Chart of the Week: Sky City Entertainment Group Ltd

Share Investor discusses Convention Centre proposal with CEO Nigel Morrison

Share Investor Q & A: Sky City CEO, Nigel Morrison

Sky City Entertainment: CEO Nigel Morrison discusses 2010 HY

Sky City Convention Centre Expansion a Money Loser: Part Two

Sky City Convention Centre Expansion a Money loser

Discuss SKC @ Share Investor Forum

Tuesday, December 17, 2019

Share Investor's 2020 Stock Picks ;)

This years picking is a little diff in that there will be no stock picks.

It has kind of run its course and ill tell you why if you be so kind to listen.

What is a stock pick but really an advert for yourself to pick whatever you want based on various methods.

I don't want to do that anymore, I see it as not helpful at all.

I would rather you pick the stock based on what you have learnt either through me or some other means.

The following para is an addendum.

Except perhaps one stock - ill let you do the research - which I see as highly undervalued and that is where perhaps stock pickers come into their own picking undervalued stocks. I am going to pick one. Sky City Entertainment. It is ripe for the picking. Anything that you can buy at less than $4 is a steal. Hope I picked well Cameron Boyd ;0

So let me finish this year by thanking everyone for joining up at Share Investor and Ill finish on about what might happen next year.

I see President Trump playing a big part in many portfolios - surprise, surprise.

I see the NZ dollar weaken.

I see bull markets to continue based on what we know so far and other indicators that are too numerous to mention.

I see interest rates drift lower (see above)

I see oil start to rise.

Gold the same.

Property in Auckland - rise. (Any monkey can pick that!)

Love as always to Sophia & Jacks 💓

Share Investor's 2019 Stock Picks

Share Investor's 2018 Stock Picks

Share Investor's 2017 Stock Picks

Share Investor's 2014 Stock Picks

Share Investor's 2013 Stock Picks

Share Investor's 2012 Stock Picks

Share Investor's 2011 Stock Picks

Share Investor's 2010 Stock Picks

Share Investor's 2009 Stock Picks

Share Investor's 2008 Stock Picks

Posted by Share Investor at 11:07 PM 2 comments

Labels: AIA, CEN, FPH, HLG, Jacks, MFT, not a stock pick, RYM, Share Investor's 2020 Stock Picks ;), SKC, Sophia

Wednesday, November 20, 2019

Buy For Yield!!

Like some of my stocks have gone up WAY out of proportion to their "importance" but one stock that I recently said sell I have to now give a buy because it has come down in price for one reason and that is because of the Tiwai Point fiasco.

It came down from the early 9's to the mid 6's and dropping.

i wouldn't be at all surprised to see it cross the ditch to land up in the high 5's.

Paying almost 6% net at current prices - not forecast to lower this years payout - this one is a steal right now.

You could get it cheaper but history says you might not - especially given today's low interest rates.

For seasoned short term sellers and long term holders.

CEN @ Share Investor

Contact Energy: Buy for Yield

Contact Energy: Time to Sell

Share Price Alert: Contact Energy 13

Share Price Alert: Contact Energy 12

Share Investor's 2019 Stock Picks

2018 Share Investor Stock Picks

Share Price Alert: Contact Energy 11

Share Price Alert: Contact Energy 10

Contact Energy: Buy Now!

Share Price Alert: Contact Energy Ltd 8

Share Price Alert: Contact Energy Ltd 7

Share Price Alert: Contact Energy Ltd 6

Share Price Alert: Contact Energy Ltd 5

Contact Energy look set to gain customers

I'm Buying: Contact Energy Ltd

Share Investor Portfolio 2: Value @ 7 July 2011

Share Price Alert: Contact Energy Ltd 4

Share Price Alert: Contact Energy Ltd 3

Share Price Alert: Contact Energy Ltd 2

Share Price Alert: Contact Energy Ltd

Stock of the Week - Reprise 5: Contact Energy Ltd

Origin Energy asset stripping Contact Energy

Stock of the Week - Reprise 4: Contact Energy Ltd

Stock of the Week - Reprise 3: Contact Energy Ltd

Long Term View: Contact Energy Ltd

Stock of the Week: Reprise 2 - Contact Energy

Stock of the Week: Reprise - Contact Energy

Not so fast Davy Boy

Still Watching Contact Energy

Beam me up Davy

Stock of the Week: Contact Energy

MarketWatch: Contact Energy - June 2009

MarketWatch: Contact Energy - Jan 2009

Contact Energy looks bright during dark times

Share Investor's 2009 Stock Picks

Follow the Monopoly Board

Discuss this stock at Share Investor

c Share Investor 2019

Posted by Share Investor at 8:30 PM 0 comments

Labels: buy, CEN, Long Term View: Contact Energy Ltd

Wednesday, October 30, 2019

Fisher and Paykel Healthcare Group: Sell

It currently sits at a tad over a 51 P.E. - which is too expensive but its holding up because it hasn't disappointed the market for about 7 years and look set to continue this stellar run for many more years but there is one thing that would stop this baby from climbing. I've said it before, ill say it again. A rise in the KIWI/US dollar.

Every 1 cent diff is $3m NZ +/- . So it is not insignificant the machinations between these two highly traded currencies because most of FPH business is done in the US dollar.

Added to this is the prospect one day and it will happen, FPH will have a bad year. Everyone is aware of this but nobody will bat an eyelid as this thing lurches from one high to the next the plain fact is this is highly susceptible to a re - rating should FPH step out of line - it has happened once before since listing in 2001.

When this happens - because any downside will be temporary - is the time to cut the profits elsewhere in your portfolio and plunk as much down as you can on this one.

FPH has patents right up the wazoo and will be busy fulfilling these. They currently employ up to $NZ125m a year next year or 9% of turnover on research and development so that patent Que is is only going to get bigger.

I will not be selling the large number of shares that I hold.

If I do ill tell ya.

Fisher & Paykel Healthcare @ Share Investor

Fisher & Paykel Healthcare Ltd: Where is it Going?

Fisher & Paykel Healthcare Ltd: Should I Buy Now?

Fisher & Paykel Healthcare Ltd: The Time to Buy

Share Investor's 2012 Stock Picks

Global Market Sell-Off Stocks: Fisher & Paykel Healthcare

Resmed takes market share from Fisher & Paykel Healthcare

Resmed kicking Fisher & Paykel Heathcares butt?

Share Price Alert: Fisher & Paykel Healthcare Ltd

I'm Buying: Fisher & Paykel Healthcare Ltd

Share Investor's Total Returns: Fisher & Paykel Healthcare Ltd

Share Investor's 2011 Stock Picks

Stock of the Week: Fisher & Paykel Healthcare Ltd

Fisher & Paykel Healthcare & the US Dollar

Mondrian Investment Partners take stake in Fisher & Paykel Healthcare

Fisher & Paykel Healthcare: 2010 Full Year Profit rests on Foreign exchange movement

Long Term View: Fisher & Paykel Healthcare

Stock of the Week: Fisher & Paykel Healthcare

Analysis - Fisher & Paykel Healthcare: FY Profit to 31/03/09

Schroder Investment Management takes big Fisher & Paykel Healthcare stake

Long VS Short: Fisher & Paykel Healthcare

Big Fisher & Paykel Healthcare trades a curious tale

Why did you buy that stock? [Fisher & Paykel Healthcare]

Drinking and Trading

Share Investor's 2008 stock picks

Share Investor's 2009 stock picks

Fisher & Paykel: A tale of two companies

FPH downgrade masks good performance

Discuss Fisher & Paykel Healthcare @ Share Investor

c Share Investor 2019

Posted by Share Investor at 4:14 AM 0 comments

Labels: Fisher & Paykel Healthcare Ltd:, FPH