Sunday, March 20, 2016

The Worst Customer Service I Have Ever Had: Jetstar

Posted by Share Investor at 11:18 PM 5 comments

Labels: AIR, Air New Zealand, Bad Service, Jetstar

Wednesday, February 3, 2016

Air New Zealand: On the Way Down

Air New Zealand is probably a very good airline.

I can either not afford to fly with them (in New Zealand I have to) and when I can it is some sort of forced codeshare thingy.

Those of you who know this blog well know i'm not a big fan of airlines and I share my fear of investing in them with that famous billionaire Warren Buffett.

I fear the end of the line for Air New Zealand, soon.

What I am saying is the number of news stories, local and international, about airlines expanding into new territories is particularly worrying. GROWING airlines, growing seats, lowering fares, its the only business I know that people(investors)get excited about prices going down - you should be worried.

The Airline has been doing ok for a number of years but this year after oil prices hit the bottom (i'm picking in the mid to high teens) and start rising things will start to move the other way.

The staff labour costs, fees paid to airports, divs to the govt, cost of food, cost of computer systems and long flights proportionately cost more. There are in the air for longer and burn a shit load of fuel.

Passengers just pay for one ticket. Air New Zealand are flying longer flights - along with everyone.

Of course there's hedging. The person in charge of this I would say has the most important job in the airline. What he does now will ultimately affect what happens a few years down the road.

By all accounts Air NZ has a very good one/s.

Be very careful if you are a long term investor. I would avoid this stock at all costs.

If however you are in it for the short term then Bobs your uncle, go for it.

You probably know when to pick it.

AIR @ Share Investor

Queenstown Airport: Loud Voices & Loyalty

Long Term View: Air New Zealand Ltd

John Palmer Tipples on the Shareholder

Mike Pero and Air New Zealand: Capitalism vs Socialism

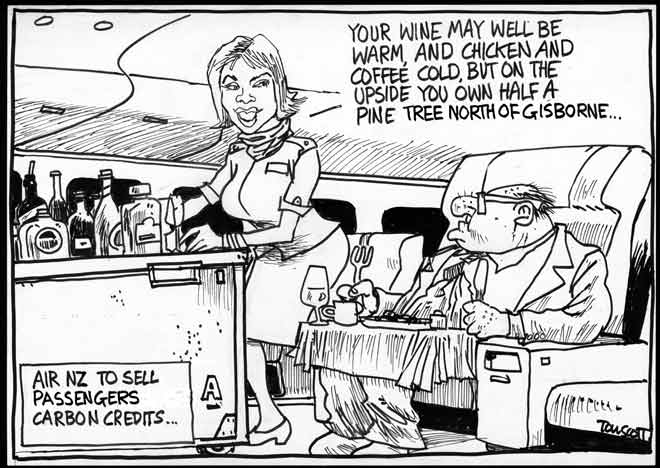

Rob Fyfe's "Environmental Extremism"

Reality Needs to Bite

Air New Zealand wants another taxpayer bailout

Discuss this stock at Share Investor

Posted by Share Investor at 11:58 AM 2 comments

Labels: AIR, Air New Zealand

Friday, January 30, 2015

Share Investors Portfolio Picks Updated

NZX up around 200 points and the portfolio up in all cases except for 3x.

I'll start with those 3 first.

That's Trademe, The Warehouse and Team Talk.

Trademe down about 25c, the Warehouse around the same and Team Talk down 60 cents due to a downgrade.

Auckland International Airport is up over 50 cents, Air NZ up over 40 cents, Contact Energy up over $1, Fisher & Paykel Health up 90 cents, Hallensteins Glassons up 20 cents, Mainfreight up just over $1, NZ Refining up over 60 cents , Heartland Bank up nearly 30 cents Sky City even and Xero just 20 cents below what it was Nov 20.

They range from Heartland up 30 per cent, to Sky City even stevens and everything else in between.

Easy to pick good ones in a market that is rising but hopefully you can see what I mean about brief profits.

Real money is to be made long term.

An Alternative to that biased, joke that is Sharetrader.

www.shareinvestorforum.com

Share Investor's Annual Stock Picks

Share Investor's 2014 Stock Picks

Share Investor's 2013 Stock Picks

Share Investor's 2012 Stock Picks

Share Investor's 2011 Stock Picks

Share Investor's 2010 Stock Picks

Share Investor's 2009 Stock Picks

Share Investor's 2008 Stock picks

Broker Picks

Brokers 2014 Stock Picks

Brokers 2013 Stock Picks

Brokers 2012 Stock Picks

Brokers 2011 Stock Picks

c Share Investor 2014, 2015

Thursday, November 20, 2014

Share Investor's 2015 Stock Picks

|

| Author at beginning of year. |

That may also not happen, if America keeps on with its wacky ways.

With this in mind here we go.

Warning

What not to buy!

At the time of writing this addition 19.12.14 11.30am the stock that I've got to mention is XRO. It is at $15.70 at time of writing and is set to make further slippages in 2015. It reached a high of over $45 and some and is many years away from making a profit - if at all. It has been 6.5 years on the NZX.

Stay away.

* As an addendum, the stocks from Fisher and Paykel to Hallensteins are stocks in the share investors portfolio and are included because they are the bomb.

The rest are very worthy additions.

An Alternative to that biased, joke that is Sharetrader.

www.shareinvestorforum.com

Share Investor's Annual Stock Picks

Share Investor's 2014 Stock Picks

Share Investor's 2013 Stock Picks

Share Investor's 2012 Stock Picks

Share Investor's 2011 Stock Picks

Share Investor's 2010 Stock Picks

Share Investor's 2009 Stock Picks

Share Investor's 2008 Stock picks

Broker Picks

Brokers 2014 Stock Picks

Brokers 2013 Stock Picks

Brokers 2012 Stock Picks

Brokers 2011 Stock Picks

c Share Investor 2014, 2015

Friday, January 3, 2014

Brokers 2014 Stock Picks

Three out of seven brokers chose the airline, whose shares have already risen more than 25 per cent this year.

Rob Mercer, an analyst at Forsyth Barr, said Air New Zealand was heading into 2014 in great shape with earnings expected to increase from those already seen in 2013.

"Air New Zealand (is) poised to deliver several years of strong profit performance."

Mercer said the drivers behind that were improved demand, cost cutting, changes to loss-making long-haul routes and stable fuel prices.

Macquarie analyst Brad Gordon said Air New Zealand had outperformed its airline peers yet it was trading at a cheaper price.

"Air New Zealand's return on equity is around 11 per cent, Qantas is basically zero."

Gordon said that in the past Air New Zealand's value had traded at a discount because of the Government's high level of ownership.

The 20 per cent sold down by the Government in 2013 reduced the overhang issue and increased liquidity in the stock. Trade volumes had been boosted from around half a million dollars a day to around $1.5 million to $2 million.

Gordon said the nature of the New Zealand market meant Air New Zealand stood to benefit from the country's strong economic growth and flow-on effects from the Christchurch rebuild with more people travelling up and down the country.

Outside of Air New Zealand, Diligent, Chorus, Fisher & Paykel Healthcare, Contact Energy, Infratil and Mainfreight received two picks each.

Diligent, a software providers of corporate board documents, was a top performer in 2012 but this year it has struggled with governance issues and delays in restating its accounts. Its shares have fallen more than 25 per cent.

Gordon was not worried about Diligent having to restate its accounts.

"It's not entirely unusual for new software companies to go through restatements globally."

The big question mark was whether the issue had distracted management and impacted sales for the company. He would be looking closely at quarterly sales figures due out early next year.

Diligent was a top pick for brokers in 2013 but remarkably none of the brokers have picked Xero either this year or for 2014, despite its stellar performance.

Gordon believed that was down to a lack of understanding over Xero's valuation. "The last $15 the company put on really there has been no news. On the face of it it's the most expensive SAAS (software as a service) company on valuation."

Others have zeroed in on companies with strong global growth prospects.

Mark Lister, head of research at Craigs Investment Partners, said he picked Fisher & Paykel Healthcare because the business is growing strongly offshore and was well positioned to continue to deliver over the medium term. "If we see any currency weakness emerge, this would serve to enhance the investment proposition even more," he said.

Lister also picked Mainfreight for its increasing international exposure.

"Mainfreight has a strong brand and market position in Australasia but over recent years, an increasing portion of revenues and earnings have come from international operations including those in Europe and the US.

"A recovery in some of these regions, as well as any strength in the currency, would benefit Mainfreight."

Forsyth Barr's Mercer said he backed Mainfreight because it had a high marginal return on equity, it was beating peers on earnings growth and had a proactive executive team.

"Mainfreight has substantial global growth prospects."

Brokers top picks:

Macquarie Securities

Summerset Group

Diligent

Pumpkin Patch

Air New Zealand

Chorus

First NZ Capital

Fisher and Paykel Healthcare

Hellaby Holdings

Airwork Holdings

Z Energy

Contact Energy

Goldman Sachs

Trade Me

Tower

Air New Zealand

Infratil

Nuplex

Craigs Investment Partners

Fisher & Paykel Healthcare

Fletcher Building

Meridian Energy

Mainfreight

Australian Foundation Investment Company

Forsyth Barr

Air New Zealand

Contact Energy

Sky Television.

Mainfreight

Opus International Consultants

Hamilton Hindin Greene

Metlifecare

Chorus

Steel & Tube

A2 Corp

NZX

McDouall Stuart

Telecom

Diligent

Infratil

Heartland Bank

VMob

*Disclaimer - Before using the Business Herald survey to choose a broker or stocks, readers should recognise that the results are skewed by some features. The figures exclude brokers fees. Brokers are asked to choose the securities that will give the best short-term performance. If they had been asked to choose, for example, a five year term, the results might be different. The survey does not allow brokers to review choices during the year. The survey implies a one-size-fits-all approach. It takes no account of individual circumstances such as an investor's appetite for risk, need for income or tax circumstances. The views expressed do not constitute personalised financial advice and are not directed at any person. Finally, past performance is no guarantee of future performance.

Share Investor's Annual Stock Picks

Share Investor's 2014 Stock Picks

Share Investor's 2013 Stock Picks

Share Investor's 2012 Stock Picks

Share Investor's 2011 Stock Picks

Share Investor's 2010 Stock Picks

Share Investor's 2009 Stock Picks

Share Investor's 2008 Stock picks

Broker Picks

Brokers 2014 Stock Picks

Brokers 2013 Stock Picks

Brokers 2012 Stock Picks

Brokers 2011 Stock Picks

| Toughen Up: What I've Learned About Surviving Tough Times byMichael Hill |

| Think Bigger: How to Raise Your Expectations and Achieve Everythingby Michael Hill |

c Share Investor 2012, 2013, 2014

Friday, February 8, 2013

Share Price Alert: Air New Zealand 2

Air New Zealand Ltd [AIR.NZX] is faltering.

Its share price has not been north of $1.50 for almost 6 YEARS !

If you are thinking of buying this stock (I must warn you again the stock is off 2007 highs) buy in the cents per share. It will be down there again soon.

Tip, invest your shekels in Boeing...

AIR @ Share Investor

Share Price Alert: Air New Zealand Ltd

Queenstown Aiport Case: Air New Zealand VS Auckland

Queenstown Airport: Loud Voices & Loyalty

Long Term View: Air New Zealand Ltd

John Palmer Tipples on the Shareholder

Mike Pero and Air New Zealand: Capitalism vs Socialism

Rob Fyfe's "Environmental Extremism"

Reality Needs to Bite

Air New Zealand wants another taxpayer bailout

Discuss this stock at Share Investor Forum - Register free

Download AIR Company Reports

c Share Investor 2013

Posted by Share Investor at 9:13 AM 2 comments

Labels: AIR, Air New Zealand

Wednesday, February 1, 2012

The Market says Rob Fyfe has failed

According to the market though he is not.

If we look at the 7 year chart below - the length of time Mr Fyfe has been with AIR NZ -.we can see that the share price has kamakazied to half the value it was when he took over in 2005.

| 7 Year AIR Chart |

Not only that, the share price is an all-time low (see 10 year AIR chart below) since the company was injected with a billion taxpayer dollars in 2002. Hardly the stuff of first-class lay back and champagne flutes.

| 10 Year AIR Chart |

Over its 10 year listing Air New Zealand has had negative returns for investors and the share price was markedly better under Sir Ralph Norris who managed the current structure of the company well through its formative years in the early 2000s.

I know airlines are notoriously difficult to run and it is hard for them to make money but the plaudits and pats on the back for him now are misplaced at best and arse kissing at worst.

AIR @ Share Investor

Share Price Alert: Air New Zealand Ltd

Queenstown Aiport Case: Air New Zealand VS Auckland

Queenstown Airport: Loud Voices & Loyalty

Long Term View: Air New Zealand Ltd

John Palmer Tipples on the Shareholder

Mike Pero and Air New Zealand: Capitalism vs Socialism

Rob Fyfe's "Environmental Extremism"

Reality Needs to Bite

Air New Zealand wants another taxpayer bailout

Discuss this stock at Share Investor Forum - Register free

Download AIR Company Reports

From Fishpond.co.nz

Buy Every Bastard Says No - The 42 Below Story, by Geoff Ross & Justine Troy & more @ Fishpond.co.nz

c Share Investor 2012

Posted by Share Investor at 12:30 AM 4 comments

Labels: AIR, Air New Zealand, Rob Fyfe, Sir Ralph Norris

Thursday, March 24, 2011

Queenstown Airport: Queenstown Airport Update

If you have been following the issues closely surrounding Auckland International Airport Ltd [AIA.NZX] and their purchase of a 24.99% stake in Queenstown Airport you will probably already know that a couple of significant pieces of news have been released on this matter over the last week or so.

If you have been following the issues closely surrounding Auckland International Airport Ltd [AIA.NZX] and their purchase of a 24.99% stake in Queenstown Airport you will probably already know that a couple of significant pieces of news have been released on this matter over the last week or so.Queenstown Lakes District Council (QLDC), through council owned subsidary Queenstown Airport Ltd, initially gave the green light for the deal last year and members on council are now opposing it and have completed a comprehensive 76 page report on it and have come to various conclusions as only a long winded ratepayer funded report can.

Their main point seems to be that Auckland Airport paid too much for their shareholding:

Page 41 of the report finds that the price paid by AIA for the first tranche shares (24.99%) was $6.91 per share:

The disclosure in this report that AIA has paid a significant premium to the present day value of the company surely runs counter to the council's opposition to the AIA/Queenstown ports arrangement? The Queenstown Airport and by default the council (which majority owns the airport) got good value for the 24.99% stake and for Queenstown ratepayers and they should be given a pat on the back for extracting every last cent out of AIA that they have. This clearly should bode well for AIA in court proceedings brought against AIA by QLDC/Queenstown Community Strategic Assets Group (QCSAG) and Air New Zealand Ltd [AIR.NZX].

There has also been an agreement by both Queenstown Airport and AIA that the option to by a further stake up to 35% is going to be given the bullet:

“On one hand Queenstown Airport could have received further cash of between $11 million and $21 million, of which the community could have received a sizable portion (around $10 million) as a dividend. On the other hand if Council ownership fell below 75% it would no longer have control of the constitution,” Ms Lawson said.

The latest developments pretty much put Queenstown Airport in the box seat as far as their partnership with AIA goes. They have a cornerstone shareholder that has allowed them to release much needed capital back onto the balance sheet and they can also use the expertise, management and size of Auckland Airport to leverage growth for the Queenstown Port.

Lets be clear though, it will be mutually beneficial for both partners but Queenstown Airport is in the box seat and will make its business decisions as it sees fit.

The High Court Judicial Review latter on this year on the port deal looks tenuous for the proponents.

Disc I own AIA shares in the Share Investor Portfolio

Queenstown Airport Buyout @ Share Investor

Auckland Airport CEO on Queenstown Airport Fracas

Queenstown Airport: Court Case looks set to Drag

Queenstown Airport: Loud Voices & Loyalty

Queenstown Airport: Air New Zealand's Crocodile Tears

Queenstown Airport: AIA purchase good Long-Term but will cost shareholders Short-Term

AIA @ Share Investor

Share Investor Q & A: Auckland Airport's Simon Moutter

Auckland Council look set for a Auckland Airport Takeover

Auckland City Council new AIA Policy Doc

Make me an offer I cant refuse: Auckland International Airport Ltd

Long Term View: Auckland International Airport

VIDEO - Simon Moutter on Australian Airport Purchase

Auckland Airport Capital Raising a fair call

Auckland International Airport lands Australian Ports

What Infratil sale of Auckland Airport stake means...

Is another Auckland Airport bid likely under a business friendly Government?

Latest Airport coverage

Cullen's move on Auckland Airport has far reaching effects

Cullen's move on AIA tax plan Anti-Business

AIA profit stays grounded

Softening opposition to CPPIB bid for AIA

Directors of AIA bribe brokers not to sell

What is Auckland Airport worth to you?

Second bite at AIA by CPPIB might just fly

AIA new directors must focus on shareholders

Auckland Airport merger deal nosedives

The Canadians have landed

AIA incentive scheme must fly out the window

Government market manipulation over AIA/DAE deal

DAE move on AIA: Will it fly?

Discuss this Stock @ Share Investor Forum - Register free

Download AIA Company Reports

THINK BIGGER: HOW TO RAISE YOUR EXPECTATIONS AND ACHIEVE EVERYTHING

BY MICHAEL HILL

c Share Investor 2011

Posted by Share Investor at 8:26 AM 0 comments

Labels: AIA, AIR, Auckland International Airport Ltd, Queenstown Airport

Thursday, March 17, 2011

Share Price Alert: Air New Zealand Ltd

Air New Zealand Ltd [AIR.NZX] shares have been doing the impression of a kamikaze pilot on speed for the first 3 months of 2011.

Even before the profit downgrade yesterday the shares had dropped from a high of $1.54 in January - the highest share price since mid 2008 - to $1.17 the day before the announcement. A loss of just under 25%.

Shares today were up 2c to $1.08 after closing down at an 8 month low of $1.06 yesterday.

The share price drop can be put down to a combination of oil price rises, and earthquakes in New Zealand and Japan but the uncertainty of its short and medium term prospects is making this company unattractive at the moment.

If you are a reader of mine you will know I am not a big fan of Airlines as investments, and I especially dislike the way Air New Zealand is run but I am going to be unbiased in my assessment anyway.

Surely there must be value in the company at these prices right?

Well if you are a long term investor like myself, forget it. Long term Air NZ has returned 6% in total over the 8 years to February 18 2010. This figure is substantially less than that given today's share price is approximately 30% lower than it was when I made my Feb 2010 calculation.

Short term though you could be onto a winner at these prices.

The Rugby World Cup should get the punters using their planes more in the first half of financial 2012 and they might be able to raise prices to recoup oil cost pressures over the rest of 2011.

After that things start to look a little shakey.

The Japanese, who are big customers of AIRs, may decide to hunker down at home instead of coming down here and the entire town of Christchurch, around 8% of our population, will not be flying anytime soon.

Oil prices may also outstrip the ability of the airline to raise prices further and not affect their patronage.

Just too many variables for a business for my liking!

You may see some more share price pressure if the situation in Japan has longer lasting effects than first thought, so some patience for a further fall might see you get shares under a dollar.

Buy on further weakness for a short term gain.

Share Price Alert

Telecom New Zealand Ltd

New Zealand Stock Exchange Ltd

Mainfreight Ltd

The Warehouse Group Ltd

Pumpkin Patch Ltd

Hallenstein Glasson Holdings Ltd

Fletcher Building Ltd

Restaurant Brands Ltd

Mainfreight Ltd

Tourism Holdings

Goodman Fielder Ltd

Pumpkin Patch Ltd

Hallenstein Glasson Holdings Ltd

NZ Refining Ltd

Freightways Ltd

Xero Ltd

AIR @ Share Investor

Queenstown Aiport Case: Air New Zealand VS Auckland

Queenstown Airport: Loud Voices & Loyalty

Long Term View: Air New Zealand Ltd

John Palmer Tipples on the Shareholder

Mike Pero and Air New Zealand: Capitalism vs Socialism

Rob Fyfe's "Environmental Extremism"

Reality Needs to Bite

Air New Zealand wants another taxpayer bailout

Discuss this stock at Share Investor Forum - Register free

Download AIR Company Reports

From Fishpond.co.nz

Buy Every Bastard Says No - The 42 Below Story, by Geoff Ross & Justine Troy & more @ Fishpond.co.nz

c Share Investor 2011

Posted by Share Investor at 5:14 AM 2 comments