Sunday, March 20, 2016

The Worst Customer Service I Have Ever Had: Jetstar

Posted by Share Investor at 11:18 PM 5 comments

Labels: AIR, Air New Zealand, Bad Service, Jetstar

Sunday, February 28, 2016

Critics and Wannabes

Just wanna counter the critics and wannabes, especially the ones you find on the internet.

Your criticism should be ignored.

If you know are doing the right thing for you, it doesn't matter who you have to answer for because the only person you have to satisfy.

Is you.

On that, ill take one instance is writing on this blog and on one particular instance on Fisher and Paykel Healthcare Ltd.

I had followed this stock for YEARS, not months and if you were to take my advice, freely of course because you don't have to take my advice, i'm just freely sharing it with you on these pages, you would have made at least 4 times your money and be in the position you are now with this company of more to come.

That's not including the 60 plus cents in divs.

Looking back i even included my advice AT THE PEAK OF MY CONFUSION AND STRIFE, IN THE MIDDLE OF A STROKE

Me:

At 1.91 today this puppy must be returning about 10%. Looks like another support level to me, if I had the money id be getting in again. Beware that this might jump down again again but also be aware that that this share traded at at 1.86 today. Depends what you want if you get it now you will return you well in the long term, if you think the traders (money) have had their fill get in now,if you don't bide your time.

An Anon Critic:

Come on, FPH is a dead end. Where its gona go and on what basis? Strong yield? How much are you expecting to gain, 10c a share?

So an answer to your critics.

Stick with it.

It will pay off.

It has for me.

Addendum : Where are all the commentators now, bet ya they are too scared to put their feelings down on paper less than 4 years latter ?

Fisher & Paykel Healthcare @ Share Investor

Global Market Sell-Off Stocks: Fisher & Paykel Healthcare

Resmed takes market share from Fisher & Paykel Healthcare

Resmed kicking Fisher & Paykel Heathcares butt?

Share Price Alert: Fisher & Paykel Healthcare Ltd

I'm Buying: Fisher & Paykel Healthcare Ltd

Share Investor's Total Returns: Fisher & Paykel Healthcare Ltd

Share Investor's 2011 Stock Picks

Stock of the Week: Fisher & Paykel Healthcare Ltd

Fisher & Paykel Healthcare & the US Dollar

Mondrian Investment Partners take stake in Fisher & Paykel Healthcare

Fisher & Paykel Healthcare: 2010 Full Year Profit rests on Foreign exchange movement

Long Term View: Fisher & Paykel Healthcare

Stock of the Week: Fisher & Paykel Healthcare

Analysis - Fisher & Paykel Healthcare: FY Profit to 31/03/09

Schroder Investment Management takes big Fisher & Paykel Healthcare stake

Long VS Short: Fisher & Paykel Healthcare

Big Fisher & Paykel Healthcare trades a curious tale

Why did you buy that stock? [Fisher & Paykel Healthcare]

Drinking and Trading

Share Investor's 2008 stock picks

Fisher & Paykel: A tale of two companies

FPH downgrade masks good performance

Discuss FPH @ Share Investor Forum

Download FPH Company Reports

| Toughen Up: What I've Learned About Surviving Tough Times by Michael Hill | |

|

c Share Investor 2016

Posted by Share Investor at 8:21 PM 2 comments

Labels: Fisher and Paykel Healthcare, FPH

Wednesday, February 3, 2016

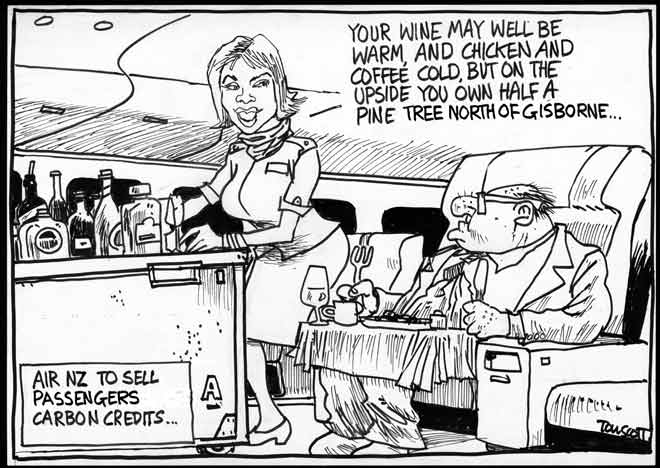

Air New Zealand: On the Way Down

Air New Zealand is probably a very good airline.

I can either not afford to fly with them (in New Zealand I have to) and when I can it is some sort of forced codeshare thingy.

Those of you who know this blog well know i'm not a big fan of airlines and I share my fear of investing in them with that famous billionaire Warren Buffett.

I fear the end of the line for Air New Zealand, soon.

What I am saying is the number of news stories, local and international, about airlines expanding into new territories is particularly worrying. GROWING airlines, growing seats, lowering fares, its the only business I know that people(investors)get excited about prices going down - you should be worried.

The Airline has been doing ok for a number of years but this year after oil prices hit the bottom (i'm picking in the mid to high teens) and start rising things will start to move the other way.

The staff labour costs, fees paid to airports, divs to the govt, cost of food, cost of computer systems and long flights proportionately cost more. There are in the air for longer and burn a shit load of fuel.

Passengers just pay for one ticket. Air New Zealand are flying longer flights - along with everyone.

Of course there's hedging. The person in charge of this I would say has the most important job in the airline. What he does now will ultimately affect what happens a few years down the road.

By all accounts Air NZ has a very good one/s.

Be very careful if you are a long term investor. I would avoid this stock at all costs.

If however you are in it for the short term then Bobs your uncle, go for it.

You probably know when to pick it.

AIR @ Share Investor

Queenstown Airport: Loud Voices & Loyalty

Long Term View: Air New Zealand Ltd

John Palmer Tipples on the Shareholder

Mike Pero and Air New Zealand: Capitalism vs Socialism

Rob Fyfe's "Environmental Extremism"

Reality Needs to Bite

Air New Zealand wants another taxpayer bailout

Discuss this stock at Share Investor

Posted by Share Investor at 11:58 AM 2 comments

Labels: AIR, Air New Zealand

Saturday, January 30, 2016

Welcome to Sharetrader Members!

I note the site Share Trader site has been down for over 24 hrs. Come on over

I note the site Share Trader site has been down for over 24 hrs. Come on overI seem to have some visitors from there reading this blog.

We have a history between us, I used to contribute as member to that aforementioned forum and was banned for having an opinion.

I have been banned for life so it seems, because I have been lurking here and there but eventually caught out.

Welcome to those of you that knew me on Sharetrader as Bongo and to those of you that don't thanks for reading this blog.

If however you would like to contribute to my Share Investor Forum, you are most welcome to sign up and let rip. I don't censor strong or contrary opinion to the website owner, nor am I bound by loyalty to advertisers or make you sign a disclosure that abdicates your right to the content you submit.

Sharetrader do!

I am independent and proud of it.

So welcome Sharetrader members, welcome to Share Investor.

You can get the forum at the following URLs:

www.shareinvestor.nz

www.shareinvestorforum.com

www.shareinvestor.co.nz

www.sharetrader.biz

c Share Investor 2010, 2016

Posted by Share Investor at 7:26 AM 0 comments

Labels: Share Investor Forum, sharetrader

Sunday, January 17, 2016

Murray & Co: Overachieving Kiwi-style

I had to hunt high and low but I found something.

This piece really has everything a little Fisher & Paykel holder really wants to know.

What he neglects to tell us is, has Mike Daniells passed all his business acumen on.

I would have to answer that by saying yes by looking at the figures, 29-800 million, in 26 years.

What is more important is, has he passed that "we are a company that is going to spend northwards of 70 million next year on R & D" and you would have to say yes again.

Lewis Gradon is still there as head of R & D and as long as he is I don't have one worry.

The biggest value creator in the history of the NZ sharemarket, Mike Daniell (CEO of Fisher & Paykel Healthcare) quietly handed in his resignation slip recently without any fanfare or great media interest.

The biggest value creator in the history of the NZ sharemarket, Mike Daniell (CEO of Fisher & Paykel Healthcare) quietly handed in his resignation slip recently without any fanfare or great media interest.Share Investor's 2012 Stock Picks

Global Market Sell-Off Stocks: Fisher & Paykel Healthcare

Resmed takes market share from Fisher & Paykel Healthcare

Resmed kicking Fisher & Paykel Heathcares butt?

Share Price Alert: Fisher & Paykel Healthcare Ltd

I'm Buying: Fisher & Paykel Healthcare Ltd

Share Investor's Total Returns: Fisher & Paykel Healthcare Ltd

Share Investor's 2011 Stock Picks

Stock of the Week: Fisher & Paykel Healthcare Ltd

Fisher & Paykel Healthcare & the US Dollar

Mondrian Investment Partners take stake in Fisher & Paykel Healthcare

Fisher & Paykel Healthcare: 2010 Full Year Profit rests on Foreign exchange movement

Long Term View: Fisher & Paykel Healthcare

Stock of the Week: Fisher & Paykel Healthcare

Analysis - Fisher & Paykel Healthcare: FY Profit to 31/03/09

Schroder Investment Management takes big Fisher & Paykel Healthcare stake

Long VS Short: Fisher & Paykel Healthcare

Big Fisher & Paykel Healthcare trades a curious taleWhy did you buy that stock? [Fisher & Paykel Healthcare]

Drinking and Trading

Share Investor's 2008 stock picks

Fisher & Paykel: A tale of two companies

FPH downgrade masks good performance

Discuss FPH @ Share Investor Forum

Download FPH Company Reports

| Project Management Essentials For Dummies, Australian and New Zealand Edition by Nick Graham Buy new: $9.74 / Used from: $8.96 Usually ships in 24 hours |

Posted by Share Investor at 12:04 PM 0 comments

Labels: FPH, Mike Daniells

Wednesday, January 13, 2016

The Warehouse: What the ***k is it doing?

Let me begin this piece with I no longer wish to be a shareholder in The Warehouse.

You have seen it before.

The Warehouse finally seems to have done the business, straightened things out and is now on the way to increased sales/revenue and therefore ever increasing profits.

It did this a few days ago when it showed 'promising signs after spending about 200 hundred million odd (this time) on this that and the other' - buying companies left/right/and centre. (the speech patterns are mine but the above takes up a good few years of this and I'm too tired to re-hash the same old stuff)

But is the Warehouse going to buy every retailer in the country in order to be 'Where Everyone Gets a Bargain?' (watch out Dick Smith)

No.

They have to get more people through their doors and the way to do that is through offering THE cheapest branded goods around.

That is it.

Leave the rest up to us.

If by the smallest of chances I'm wrong and this is just the beginning of a new era of the red sheds,

Good luck.

But, you have lost a loyal supporter.

The Warehouse Group @ Share Investor

Share Investor Q & A: The Warehouse' Ian Morrice

Share Investor Q & A: Questions to The Warehouse' Ian Morrice

Long Term View: The Warehouse Group Ltd

Share Investor Short: Warehouse Group yield worth a look

The Warehouse Group: 2010 Interim Profit Review

The Warehouse: Big Brands, Big Opportunities

Warehouse strike opportunity to buy

Long Term Play: The Warehouse Group

Share Investor Short: Warehouse Group yield worth a second look

Woolworths supermarket consolidation an indicator of a move on the Warehouse?

Stock of the Week: The Warehouse Group

Warehouse 2009 interim profit a key economic indicator

When will The Warehouse bidders make their move?

Long vs Short: The Warehouse Group

Warehouse bidders ready to lay money down

The Warehouse set to cut lose "extra" impediment

The Warehouse sale could hinge on "Extra" decision

The case for The Warehouse without a buyer

Foodstuffs take their foot off the gas

Woolworths seek leave to appeal to Supreme Court

Warehouse appeal decision imminent

Warehouse decision a loser for all

Warehouse Court of appeal decision in Commerce Commission's favour

MARKETWATCH: The Warehouse

The Warehouse takeover saga continues

Why did you buy that stock? [The Warehouse]

History of Warehouse takeover players suggest a long winding road

Court of Appeal delays Warehouse bid

The Warehouse set for turbulent 2008

The Warehouse Court of Appeal case lay in "Extras" hands

WHS Court of Appeal case could be dismissed next week

Commerce Commission impacts on the Warehouse bottom line

The Warehouse in play

Outcomes of Commerce Commission decision

The fight for control begins soon

Discuss WHS @ Share Investor Forum - Register free

Download WHS company reports

| Security Analysis: Sixth Edition, Foreword by Warren Buffett (Security Analysis Prior Editions) by Benjamin Graham Buy new: $41.77 / Used from: $32.40 Usually ships in 24 hours |

c Share Investor 2016

Posted by Share Investor at 10:45 AM 0 comments

Labels: The Warehouse Group, WHS

Tuesday, January 12, 2016

Some bedtime reading: Graham and Dodd's "Security Analysis"

I am in the process of re-reading David Dodd and Benjamin Graham's 1934 bible on investing.

Security Analysis.

It deserves a re-read after a life changing event like a stroke and from what I have read so far it kind of reinforces the conclusions I came to before heading down its 725 pages.

This 725 page giant of a book was written at a time where the global economy was in a depression brought on by the over exuberant roaring 20s and the subsequent 1929 stockmarket crash.

This book was initially looked at when were going through what they call, 'The Great Recession' in 2008 - you fill in your year for the finish.

It has had several updates since its original edition and is often hard to come by in your local bookstore. A sixth edition was out in 2008, when I originally wrote this. I wanted to read the original book to get a feeling for the markets and general investment outlook of the time. Its relation to today's market conditions is still important to me.

From the Amazon preview of the first edition of Security Analysis:

The original words of Benjamin Graham and David Dodd--put to paper not long after the disastrous Stock Market Crash of 1929--still have the mesmerizing qualities of rigorous honesty and diligent scrutiny, the same riveting power of disciplined thought and determined logic that gave the work its first distinction and began its illustrious career.

In their preface to this book, Graham and Dodd write that they hope their work "will stand the test of the ever enigmatic future." There is no doubt that it has.

Now I have other books on my reading list but I want to tackle this one first, principally because it was the text that Warren Buffett based much of his investing style on and as my regular readers know I am a Warren Buffett nut.

I have already read Benjamin Graham's The Intelligent Investor but I felt I needed a more detailed analysis of his investment style and his and Dodd's Security Analysis tome fits that bill to a tee.

Many stockbrokers in the past have used Security Analysis to go back to in times of doubt, and given current market turmoil investors might be wise to start reading.

It is clear the majority of stockbrokers in the United States and in other global markets haven't even turned a page of this essential investment tool and I know that is more than the case in New Zealand stockbroker circles.

My local ASB Securities broker said what? when I asked him during a related conversation if he had even heard of the book! Even The Intelligent Investor was another language to him.

You can get a physical copy of the book from the Share Investor Bookstore or download it free here.

Related Reading

Share Investor Forum - Discuss this topic

c Share Investor 2008 & 2016

Posted by Share Investor at 10:30 AM 0 comments

Labels: 2016, benjamin graham, David Dobbs, Investing Books, Security Analysis, The Intelligent Investor, warren buffett

Thursday, January 7, 2016

AIA: To Buy Now Or Not To?

Would you buy Auckland Airport shares right now?

That is a very good question considering the first half profit will be announced next month you would have to say leave it to the other side of this announcement.

You would also have to say what about China whats it doing?

Well as far as the announcement is concerned that is going to be a good one for share holders - north of $80 mill for the half and that is more than likely going to boost the share price to past $6.

So the second question is worth looking at because it is a good one.

Is it worth waiting until the shite hits China then buy up or risk the share going up in price.

I bought my shares at 1.70, 1.50 and - 1.90, I think. I bought the during the depths of the great recession and they have turned out to be by best investment.

They have returned over 600% and my only regret is that I didn't buy 40,000.

SO, what are they going to do?

Well I can give you two pieces of advice because you are the one putting money on the line.

You can buy now with the inevitability that you are going to see similar returns (over 600%) or be patient (or if you think the China thing is another bubble you wont have to wait long) and wait it out till the stock-market has a correction (its not overvalued if you compare the income your getting from stocks to interest from the bank/having an investment house but long term it is overvalued on P.E ratios and a number of other financial ratios. )

I going to stay shtuck (my google dictionary says that is not a word)on this for now and let you decide.

Whatever your decision it will be interesting.

AIA @ Share Investor

Share Investor Q & A: Auckland Airport's Simon Moutter

Auckland Council look set for a Auckland Airport Takeover

Auckland City Council new AIA Policy Doc

Make me an offer I cant refuse: Auckland International Airport Ltd

Long Term View: Auckland International Airport

VIDEO - Simon Moutter on Australian Airport Purchase

Auckland Airport Capital Raising a fair call

Auckland International Airport lands Australian Ports

What Infratil sale of Auckland Airport stake means

Is another Auckland Airport bid likely under a business friendly Government?

Latest Airport coverage

Cullen's move on Auckland Airport has far reaching effects

Cullen's move on AIA tax plan Anti-Business

AIA profit stays grounded

Softening opposition to CPPIB bid for AIA

Directors of AIA bribe brokers not to sell

What is Auckland Airport worth to you?

Second bite at AIA by CPPIB might just fly

AIA new directors must focus on shareholders

Auckland Airport merger deal nosedives

The Canadians have landed

AIA incentive scheme must fly out the window

Government market manipulation over AIA/DAE deal

DAE move on AIA: Will it fly?

Queenstown Airport Buyout @ Share Investor

Queenstown Airport: Queenstown Airport Update

Auckland Airport CEO on Queenstown Airport Fracas

Queenstown Airport: Court Case looks set to Drag

Queenstown Airport: Loud Voices & Loyalty

Queenstown Airport: Air New Zealand's Crocodile Tears

Queenstown Airport: AIA purchase good Long-Term but will cost shareholders Short-Term

Discuss this Stock @ Share Investor Forum - Register free

c Share Investor 2016

Posted by Share Investor at 6:56 PM 2 comments

Labels: AIA, Auckland International Airport Ltd, Buy AIA now or in the future?