Air New Zealand is probably a very good airline.

I can either not afford to fly with them (in New Zealand I have to) and when I can it is some sort of forced codeshare thingy.

Those of you who know this blog well know i'm not a big fan of airlines and I share my fear of investing in them with that famous billionaire Warren Buffett.

I fear the end of the line for Air New Zealand, soon.

What I am saying is the number of news stories, local and international, about airlines expanding into new territories is particularly worrying. GROWING airlines, growing seats, lowering fares, its the only business I know that people(investors)get excited about prices going down - you should be worried.

The Airline has been doing ok for a number of years but this year after oil prices hit the bottom (i'm picking in the mid to high teens) and start rising things will start to move the other way.

The staff labour costs, fees paid to airports, divs to the govt, cost of food, cost of computer systems and long flights proportionately cost more. There are in the air for longer and burn a shit load of fuel.

Passengers just pay for one ticket. Air New Zealand are flying longer flights - along with everyone.

Of course there's hedging. The person in charge of this I would say has the most important job in the airline. What he does now will ultimately affect what happens a few years down the road.

By all accounts Air NZ has a very good one/s.

Be very careful if you are a long term investor. I would avoid this stock at all costs.

If however you are in it for the short term then Bobs your uncle, go for it.

You probably know when to pick it.

AIR @ Share Investor

Queenstown Airport: Loud Voices & Loyalty

Long Term View: Air New Zealand Ltd

John Palmer Tipples on the Shareholder

Mike Pero and Air New Zealand: Capitalism vs Socialism

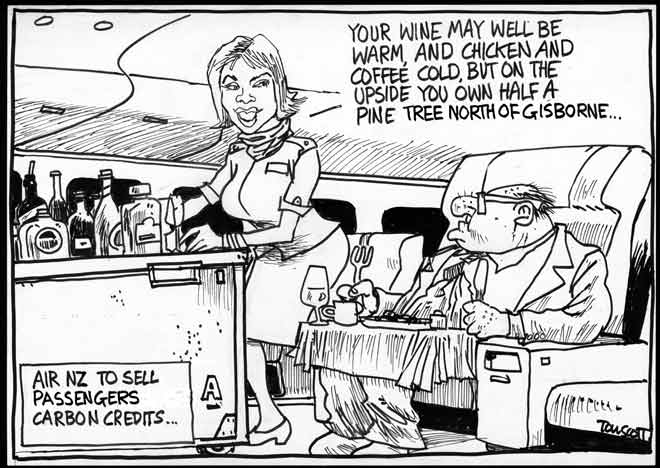

Rob Fyfe's "Environmental Extremism"

Reality Needs to Bite

Air New Zealand wants another taxpayer bailout

Discuss this stock at Share Investor

The biggest value creator in the history of the NZ sharemarket, Mike Daniell (CEO of Fisher & Paykel Healthcare) quietly handed in his resignation slip recently without any fanfare or great media interest.

The biggest value creator in the history of the NZ sharemarket, Mike Daniell (CEO of Fisher & Paykel Healthcare) quietly handed in his resignation slip recently without any fanfare or great media interest.