I have had a correspondent through email over several months asking me about whether he should sell his Sky City Entertainment Group Ltd [SKC.NZX] shares. In March he asked the following question.

I have had a correspondent through email over several months asking me about whether he should sell his Sky City Entertainment Group Ltd [SKC.NZX] shares. In March he asked the following question.

I'm a big fan of your blog, checking it most days for updates (particularly after a tough day on the sharemarket).

My answer was:

Now I don't really recommend what others should be doing with their

shares or investments but I will tell you what I am going to do with

my SKC shares and why and maybe that will give you an idea.

The rider is that your circumstances will be different to mine: the

dollar amount you are talking about will be different, your investment

term might be longer or shorter, you may have held the shares longer

or shorter than me, etc ,etc.

You will have to decide based on those and other conditions.

I have held my 35000 shares for around 6 years and hold them at a cost

of just over 2 bucks a share.

I don't check share prices daily but it sounds like the SP is around

$NZ 3.70 odd as of today. That is the lowest price they have ever been

since 2002 but at one stage mine were worth $70000.00 more at their

high point of around $5.70.

My investment term for shares is a minimum of 10 years, so I'm not

particularly worried about their current share price. Every share is

getting battered.

The current uncertainties re the credit crunch are a concern to me and

I believe shares could drop another 20% easily, so be prepared for

your shares to drop below 3 bucks.

In the long run though, SKC shows some promise.

The new head seems aggressive in his desire to improve business

without buying more businesses and he has the track record in other

casinos to back up his big mouth.

Some fat has been trimmed from operating costs and I believe the

company is ready to bounce back.

The company does have a largish debt burden but has very cheap credit

funding secured for many years.

The only cloud on the horizon is government legislation.

It is a great cash business, a monopoly in most of its markets and a

great hedge in uncertain economic times.

I have no intention of selling, but if you need the money the shares

are not going to improve in value until the credit crunch has blown

over and that is going to take many months to come.

I hope that has been helpful.

In subsequent emails my correspondent continued to fret over the plunging price of his Sky City holding.

I answered that the company will do OK in a recession, with the implication being that other companies will suffer.

Retailing stocks in New Zealand have been especially hard hit. I have held several retail stocks for some years but given plunging stock prices have bought some new retail stocks, as well as other sectors, into the Share Investor Portfolio.

The general point made to my correspondent was that you shouldn't sell your shares unless you really needed to or if there was something significantly wrong with the company you invested in.

The Sky City example makes a good general point. Stocks and investments are losing value currently. There are good reasons why that is the case. A probable global recession brought on by the Sub Prime credit crunch and high oil, interest and food costs will have impacts on company profits. That will not last forever though, so unless you need the money selling is not a good idea.

You invested in a business and businesses have good and bad times. Get used to it.

Investors who sold Sky City over its share price rort will probably be kicking themselves. The capital value of the company has nearly halved since February but the profit guidance made in that month was re affirmed yesterday.

"There's a lot of concern that in this environment there are a lot of companies contemplating earnings downgrades and we wanted to confirm that we weren't," SkyCity chief executive Nigel Morrison said.

Proving that Mr Market has gone overboard in marking this company down.

Sky City isn't recession proof though. Expect it to struggle slightly in the 1 July to 31 Dec half.

Other stocks listed on the NZX have also been oversold in my opinion.

My correspondent didn't sell his Sky City shares shares.

Disc: I own SKC shares in the Share Investor Portfolio

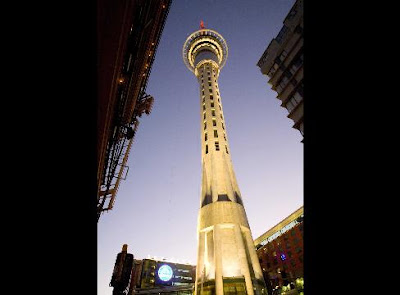

Sky City Convention Centre @ Share Investor

Share Investor discusses Convention Centre proposal with CEO Nigel Morrison

Sky City Convention Centre Expansion a Money Loser: Part Two

Sky City Convention Centre Expansion a Money loser

SKC Convention Centre power-point slide illustrations & SKC submission to Auckland City Council

Sky City Entertainment Group @ Share Investor

Sky City Entertainment Group Ltd: Presentation to Macquarie Group

Morningstar Revalues Sky City Entertainment Group

Guest Post - Michele Hewitson Interview: Nigel Morrison

Failed Sky City bid for Christchurch Casino good news for Shareholders

Sky City Entertainment Group Ltd: Christchurch Casino bid falls short of Investment Criteria

Sky City Entertainment Group Ltd: Never mind the width feel the volume

Sky City Annual Meeting & 2011 - 2012 Profit Forecast

Stock of the Week: Sky City Entertainment Group Ltd

Sky City set to lose National Convention Centre bid

Sky City Entertainment Group: Australian Acquisition on the Cards?

Sky City Entertainment Group Ltd: 2010 Full Year Profit Analysis

Sky City Entertainment Group 2010 Full Year Profit Preview

Chart of the Week: Sky City Entertainment Group Ltd

Share Investor discusses Convention Centre proposal with CEO Nigel Morrison

Share Investor Q & A: Sky City CEO, Nigel Morrison

Sky City Entertainment: CEO Nigel Morrison discusses 2010 HY

Sky City Convention Centre Expansion a Money Loser: Part Two

Sky City Convention Centre Expansion a Money loser

Sky City Entertainment Group Ltd: Download full Company analysis

Sky City 2010 full year profit looking good

Long Term View: Sky City Entertainment Group Ltd

Sky City Entertainment: CEO Nigel Morrison discusses 2010 Half Year

Sky City Entertainment Group 2010 Interim Profit Review

Sky City to focus on Gaming

Sky City debts levels now more manageable

Insider Trading on Sky City shares

Sky City Profit Upgrade: Always on the Cards

Sky City's Current Cinema "Boom" a Horror Story in Disguise

Stock of the Week: Sky City Entertainment Group

Are Insiders selling Sky City Stock?

Sky City Entertainment 2009 Interim Result Preamble

2008 Sky City profit analysis

Sky City share offer confusing and unfair for smaller shareholders

Sky City Entertainment 2008 Full Year profit results , NZX release, 2008 full year presentation, result briefing webcast, financial statements

Sky City 2008 profit preamble

Sky City outlines a clear future plan

As recession bites Sky City bites back

Sky City Assets: Buy, sell and hold

Why did you buy that stock? [Sky City Entertainment]

Sky City Share Volumes set tongues wagging

Sky City half year exceptional on cost cutting

NZX Press release: Sky City profit to HY end Dec 2007

Sky City Cinemas no Blockbuster

Sky City Entertainment share price drop

New Broom set to sweep

Sky City Management: Blind, deaf and numb

Sky City sale could be off

Opposition to takeover

Premium for control

Sky City receives takeover bid

Sky City Casino Full Year Profit to June 30 2007

Setting the record straight

Sky City CEO resigns

Sky City Casino: Under performing

Sky City Casino 2007 HY Profit(analysis)

Sky City Casino 2007 HY Profit

Discuss SKC @ Share Investor Forum

Download SKC Company Reports

Recommended Amazon Reading

The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Counsel (Revised Edition) by Benjamin Graham

Buy new: $14.95 / Used from: $6.99

Usually ships in 24 hours

c Share Investor 2008