|

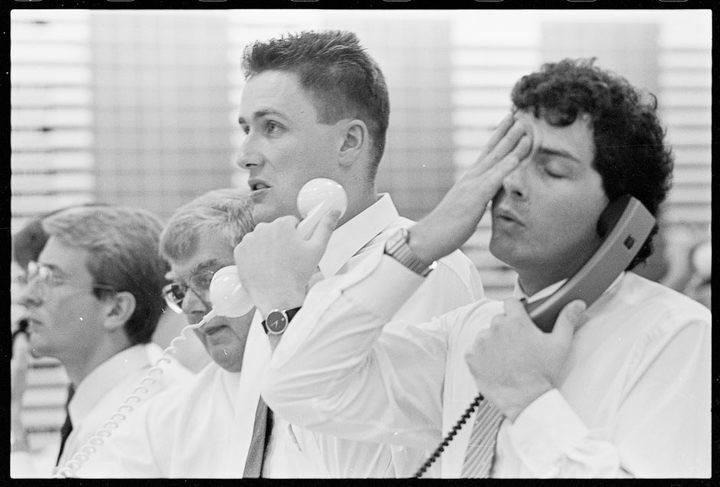

| Looked for photo in the Herald but could only find this one. Picture tells a thousand words. |

Share Investors Portfolio @ 17 Oct 2017

The question raised by most pundits this week is will the 1987 share market crash that happened in this country on the 20th October 1987 and in the rest of the world the day before happen again?

I would contend its not when it will happen because it will.

I don't pretend to know just when it will because I don't know.

Lets be clear, the reasons for the 87 crash were varied and wide - depending on who you talk to - but the reasons in this part of the world were a lot different to those in the Northern Hemisphere.

Here apart from anywhere in the world we were going through a vast transformation.

Business was moving and becoming clearer and cleaner. Restrictions to all business were removed and we were at the centre of a global experiment which was being watched from Wall Street to Fleet St and then tried there in the 1990's and 2000's.

NZ INC was closed one minute - under Rob Muldoon and then open the next day thanks to Roger Douglas.

Capital moved in from overseas then we were in the grip of a financial tsunami, the likes of which we hadn't seen before.

And what did people invest in?

Bugger all really.

Most of the businesses floated on the stock market at that time had very little to do with real business and those that were doing "good" business were taken along for the ride.

Unfortunately these good businesses were taken down on the 20th October 1987 along with the other ones that shouldn't have been listed in the first place.

Fast forward to today when we have restrictions and various rules around investing on the NZX - there are certainly not enough but its getting there.

The share market is a vastly different space to what it was 30 years ago.

We have companies that actually make money and for the ones that don't have yet it is in investors hands whether they stay or go.

It is largely up to the investor how much risk they are will to take or make.

BUT and it is a healthy but. There has been risk as long as there has been 2 people willing to trade with each other.

Inherently there is greed and that is the key word and there is no way you will ever get around it.

As long as we have greed and avarice we can be assured that we will have another share market crash.

Just when?

Share Investors Portfolio @ 17 Oct 2017

Share Investor Reading

Stockmarket Education: How do you buy shares?

Stockmarket Education: What is a Share?

Stockmarket Education

Stockmarket Dictionary

Stockbrokers: What you should know before choosing one

10 Basic questions to ask before investing

How the Stockmarket works

Understanding Risk

Watch Your Risk Tolerance

Stockmarket Education: What is a Share?

What Moves the Stockmarket?

7 Signs of Shareholder Friendly Management

Financial Media For Investors

Dividends in detail

Related Links

NZX - How to Invest

c Share Investor 2017