The Kiwi stockmarket is down markedly off its highs last year but the real test or indicator of company health and capital value lies in real results and an indication of the future prosperity or otherwise of the company that you have invested your hard earned dollars in.

Gather 'round investors! Reporting season is the moment of truth.

The New Zealand reporting season kicks off in August and regardless of the Credit Crunch and its fallout, record high energy prices, a bursting housing bubble and high food costs for consumers, financial results and future indication of direction are still the main indicators of company health and a company's possible day to day market value.

The slowing economy and its fallout is expected to vary widely impact wise on Kiwi companies. Of our top 30 stocks reporting, 10 were indicative of their respective fields: Auckland International Airport [AIA ] Briscoe Group [BGR] Telecom [TEL] Freightways [FRE] Fletcher Building [FBU] Goodman Fielder [GFF] Contact Energy[CEN] Tourism Holdings[THL] PGG Wrightson[PGG] and The Warehouse[WHS].

Both Briscoe Group and The Warehouse have warned of lower profits over the last week

Many companies have already indicated profit warnings, Hallenstein Glassons[HLG] and Postie Plus(PPG) have come to the table, while many companies have indicated flat earnings, The Warehouse, Telecom, Contact Energy, Sky City Entertainment[SKC] Pumpkin Patch(PPL) and Freightways have all indicated pressure on margins over the past year.

The pressure has come mainly from government intervention, with some of the obvious fuel, interest and food cost increases not helping. Increased labour costs through a higher minimum wage, 1 week extra holiday and paid maternity leave have all pressured businesses and margins. The recent increases of diesel and road user taxes by government have pushed the cost envelope to bursting. Clearly those companies with very high staff numbers will be affected by this, retailers especially.

In addition to the above, more Government associated paperwork for administration staff has lead to lower productivity.

More Government pressure from reckless spending has led to higher interest rates, for consumers and lending for business, and the increases in energy costs, due to Government dictated taxes on petrol and electricity have made 2008 a bad year and are due to get considerably worse in 2009, even under a new government.

There maybe some surprises on the upside during the current reporting season.

Sky City is likely to be one of the better performers this reporting season as economic downturns don't usually affect gaming businesses as much as retailers or infrastructure companies, like Contact Energy. Sky's Cinema business is going to have an awful result though.

Mainfreight[MFT] looks like a good bet to increase profit and Restaurant Brands[RBD], the often talked about whipping boy here should show an increase from a very low comparison this time last year.

This reporting season seems like a turning point for investors to me.

They must make up their minds whether they want to hold their investments during a coming hard year or run crying for the hills with their share proceeds in their hands.

Fortune will favour those who hang on to good companies and if you are buying shares for the first time or adding to your portfolio, look for good management first before anything else, for it is good managers with a track record that will be able to ride out the inevitable tough times.

I'm ready to face the coming months, good or bad, and reporting season is definitely going to give investors a clearer indication of exactly where their companies and therefore investments are going.

There is too much panic at the moment and decisions to sell by some who already want to should be put off after they hear company announcements this coming August.

Disclosure I own WHS, PPL, PPG, FBU, FRE, SKC, HLG, GFF and AIA shares

The economy looks bad now? But wait there's more!

The Warehouse set for a turbulent 2008

New Zealand Stockmarket set for a discontent Winter and Summer

c Share Investor 2008

Monday, July 7, 2008

August reporting season will give investors a true barometer of company health

Posted by Share Investor at 3:33 AM 0 comments

Labels: August 2008 reporting season, fletcher building, Freightways, Telecom New Zealand

Sunday, July 6, 2008

Why Did you buy that stock? [Briscoe Group]

A recent addition to my portfolio, Briscoe Group[BGR], like every other listed New Zealand retailer, has had its share price slashed over the last few months because of a stagnant economy and poor sales. Briscoe Group is the operator of 3 store types, Briscoes Homeware, Rebel Sport and upmarket homeware store Urban Loft.

Why did you buy that stock?

Why did you buy that stock? [Fisher & Paykel Healthcare]

Why did you buy that stock? [Pumpkin Patch Ltd]

Why did you buy that stock? [Ryman Healthcare]

Why did you buy that stock? [Michael Hill International]

Why did you buy that stock? [Mainfreight]

Why did you buy that stock? [The Warehouse]

Why did you buy that stock? [Goodman Fielder]Why did you buy that stock? [Auckland Airport]

Why did you buy that stock? [Sky City Entertainment]

In this Why Did You Buy that Stock? I have to reveal the compelling reason why I bought was the cheap historic price. Not a singular good reason to buy a stock, any investor will tell you but I cant pass up a distressed good company.

Sure, Briscoe Group has just announced a profit downgrade, one of a number over the last few years, but all retailers are suffering at the moment and the retailing scene in New Zealand will recover. Now really is the time to be buying these marked down retail companies.

The management of BGR have done well to position Bricoes and Rebel Sport in an area of the retail sector in New Zealand where they are clearly the leaders in what the sell. This is a tough ask in a crowded and highly competitive retail environment.

Every time one thinks of buying a towel, cheap frying pan or cheap Chinese wine goblet they usually think of Briscoes first-it is hard to miss their saturation advertising and continuous "sales". The same can be said of quality sports gear from Rebel Sport. They are both well known "category killers".

Rod Duke, CEO and majority owner of the company, has done well to run BGR successfully in such a small market. Given that, the size of the company cant get alot bigger.

Future profit increases will come from cost cutting and an improving economy and Duke has his brands well positioned for profit improvement, with the exception of the struggling Urban Loft, as the macro environment becomes more positive.

One other main attraction for me to buy this stock is the company's low debt and very high cash in the bank. As we all know this allows business to cope when the rain comes and boy is it coming down in cats and dogs now.

Even though I just bought my 3000 BGR shares last week, I would answer the question I always ask in this column in the positive, about whether I would buy more given the opportunity-with a rider in this case.

Given the current whacked out nature of the retail sector, any new purchase of this stock would have to be at a share price of 75c or less. The closing price this last Friday was 91c.

Related Share Investor Reading

I'm Buying

NZ Retailers ring up costs not tills

| Security Analysis: Sixth Edition, Foreword by Warren Buffett (Security Analysis Prior Editions) by Benjamin Graham Buy new: $41.51 / Used from: $29.98 Usually ships in 24 hours |

c Share Investor 2008

Posted by Share Investor at 12:01 AM 0 comments

Labels: BGR, Briscoe Group, Rod Duke, share investor portfolio, share investor stock picks, why did you buy that stock?

Saturday, July 5, 2008

What is Jan Cameron up to? (UPDATE 4)

(PPG share purchase update) On Monday 5 July 2010 she bought 600,000 shares to take her holding in PPG to 19.26% or 7,702,537 shares. She previously held 17.76%.

Cameron, who sold a 51 % stake in her Kathmandu outdoor clothing company for NZ$275 million in 2006, would now own over 7 million shares in PPG for a sum of less than $5 million.

The 19.26% of PPG Cameron now owns is not far short of the 20% takeover threshold where if she wanted more of the company she would have to make an offer to all shareholders for their holdings.

Like her competitor in retailing, Rod Duke, who has recently built up a stake in Pumpkin Patch Ltd [PPL.NZ] she could be just taking advantage of beaten down stock prices, with a small non controlling stake in Postie Plus or building up a holding for a possible takeover. This doesn't seem likely though.

Jan likes control in her business life so it would be natural to assume that she could see herself as an outright owner of Postie Plus.

At current share prices, in theory at least, she wouldn't have to pay more than $14 million for the remaining 32 million shares in the company. Of course a premium would have to be paid for full control but either way she could probably grab the entire company for less than $20 million.

There is no doubt that Cameron is a canny business woman. She built Kathmandu from a small one store retailer in Melbourne in 1987 to a medium sized outdoor "lifestyle" chain with 46 stores, in Australia, New Zealand and Great Britain.

Given her successful past there must be something that she sees in Posties Plus that makes its future better than it is currently.

Postie Plus has three different brands in its store stable. Postie Plus, Arbuckles and Baby City.

Out of these, Postie Plus is doing satisfactorily, Baby City are doing very well and Arbuckles, the manchester business was sold to Cameron in its entirety on June 10.

I could see how Cameron might be interested in Baby City as a brand to grow. This brand, specializing in baby clothing and accessories, is operating in a sector ripe for more branded chain store competition. Baby City really has only one serious branded competitor in New Zealand in Pumpkin Patch. With a little of Cameron's retailing magic Baby City could be a good place for her to start a much larger brand, although recent revelations that Cameron has bought a 6.3% stake in the Pumpkin might give that sort of speculation a lively twist.

The Postie Plus brand is a chain that has recently undergone a bit of a revamp. From selling conservative clothing to older people, especially women, it has now gone slightly more upmarket with a broader range of goods for a larger customer base. It is still struggling in the current economic downturn but with Cameron's retailing expertise and well known focus on minimising cost it could well do better under her guidance.

It is great to see one of New Zealand's more successful business women take an interest in a company with a beaten down capital value.

She likes to take control of her business interests (who doesn't) and is a very aggressive player.

She currently has a number of different retailing interests. A new one, Nood, a home wares store, is going head to head with Briscoe Group [BGR.NZ] Urban Loft stores. Like most New Zealand retailers, Briscoes is struggling at present.

With Cameron's track record and stake in Postie Plus it will be curious to see what her next move might be.

In October 2009 that question has been answered in that Jan has made a move against her former company Kathmandu, who is currently perusing and IPO, by making public her plans to go into competition with them in the outdoor clothing market.

Jan Cameron @ Share Investor

Jan Cameron ready to move on Postie Plus Group?

Kathmandu's 2011 Results Under Pressure from Jan Cameron

Kathmandu IPO: Jan Cameron lands a blow to IPO

What is Jan Cameron up to?

Kathmandu @ Share Investor

Kathmandu IPO: Prospectus Analysis

Kathmandu IPO: Jan Cameron lands a blow to IPO

Kathmandu IPO: What is it worth?

Kathmandu IPO: Retail Interest HighKathmandu IPO: A tough mountain to climb

Kathmandu No.1 but IPO should get the Bullet

Download the detailed Kathmandu Value Cruncher Report - Requires free registration at Share Investor Forum to download

Download Kathmandu IPO Prospectus

Discuss Kathmandu at Share Investor Forum

c Share Investor 2008

Posted by Share Investor at 9:05 PM 0 comments

Labels: Jan Cameron, Kathmandu, NZ retailers, Postie Plus Group, pumpkin patch, Rod Duke

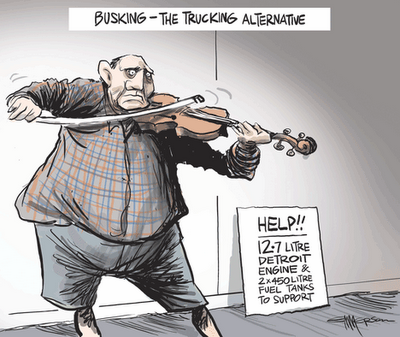

Big wheels rolling, were moving on

Emmerson, Friday July 4 , NZ Herald

Emmerson doesn't seem sympathetic to the truckie's protest but the majority of Kiwis are behind them.

It will be interesting to see what the next political Polling will uncover given the awful week Labour has had.

The week started with the backfiring of accusations made against our future Prime Minister, John Key, by Ms Clark, that he had some sort of conflict of interest over owning NZ Rail shares and asking political questions about the company.

Tuesday rolled along and we found out that the NZ$1.7 billion, so far, to be spent on buying Toll Rail and renaming it KiwiRail was unaccounted for, there was no idea how much money it would need to operate it, that it would never make money and that Toll had been paid a taxpayer subsidy to compete against other truck companies.

That same day Annette King broke her promise to give truckers fair warning of road user charge increases.

Revealed in Parliament Wednesday, that a primary school had been left with leaky classrooms,smelly toilets and sewerage soaked playing fields for 3 years with no government intervention.

Friday rolls around and protests not seen in this country against a government for generations elicits an arrogant, ignorant response from Helen Clark- "I didn't see or hear anything, I was too busy".

Can it get any worse next week?

Related Political Animal Reading

The backlash has begun

Waiting for the backlash

c Political Animal 2008

Posted by Share Investor at 12:01 AM 0 comments

Labels: Bad week for Labour Government, Emmerson Cartoon, New Zealand Political week