Black Tuesday

On 20 October 1987 the news of share market falls on Wall street sparked a dramatic day of selling on the New Zealand market. The NZ market lost 60% of its value and has yet to recover 1987 pre-crash levels, while our cousin across the ditch, lost 42%.

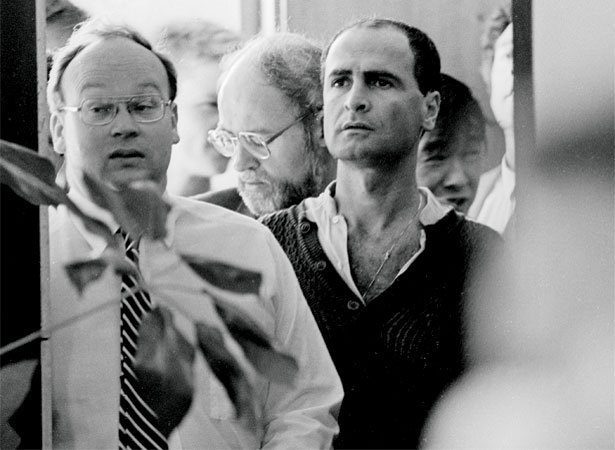

Share prices reached an all-time high on 18 September 1987. The exchange had 309 listed companies, far more than ever before. From 1982, when the international bull market began, the New Zealand market rose about 600% (compared with 250% in the US and 400% in Australia). Spooked by a dramatic fall on Wall Street, the New Zealand stock market collapsed on 20 October, which became known as ‘Black Tuesday.’ Share values dropped by $5.7 billion – 4.3% – in four hours, as thousands of investors fled the market. Values halved over the next 10 months. In the following years, New Zealand’s recovery lagged far behind those of its chief trading partners. By 1993 only 140 companies remained listed.

Most broking firms drastically downsized and many fell over. To survive, many companies merged or were taken over – some by overseas firms. This boosted their capital and attracted more off-shore investors. By 1996 over half of New Zealand broking firms had overseas connections.

The NZX is now a much better run institution than it once was, but many of the same people from 20 years ago remain and many of the same ideas of short term gains continue to live in the minds of brokers and company analysts.

Share Investor Reading

New Zealand Stockmarket: A History from beginning to present day.

Stockmarket Education: How do you buy shares?

Stockmarket Education: What is a Share?

Stockmarket Education

Stockmarket Dictionary

Stockbrokers: What you should know before choosing one

10 Basic questions to ask before investing

How the Stockmarket works

Understanding Risk

Watch Your Risk Tolerance

Stockmarket Education: What is a Share?

What Moves the Stockmarket?

7 Signs of Shareholder Friendly Management

Financial Media For Investors

Dividends in detail

Related Links

NZX - How to Invest