Further to a post I made yesterday about opportunities to buy cheaper stocks, I touched briefly on the state of the economy.

Further to a post I made yesterday about opportunities to buy cheaper stocks, I touched briefly on the state of the economy.

Let me expand on that if I may today and we will forget it again for another 6 months, because I know it is easy to bitch and moan about this stuff as I have done on a number of occasions.

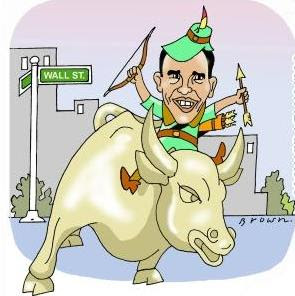

In my opinion the current economic downturn is going to take years to recover from. We have seen a relaxing of the fervour that started in September 2008, following the collapse of big financial institutions the world over and since then we have had an apparent lift in confidence due to trillions of dollars of borrowed and the printing of currencies (cheers China!) and a subsequent lift in various financial indicators; slow down in jobless growth, small GDP growth, global trade improving, etc, etc.

As I said above though, this move towards the positive is based on borrowed money and it has to be paid for, eventually.

As many of you will know, including myself, a mortgage like that can be hard to pay back when your income might now be less than it once was and while you are paying that back other forms of spending will be cut back and clearly that impacts on the economy. This huge unprecedented debt is going to constrain the economy in New Zealand and in every other country deep in debt. Even China, who is the lender, will be impacted because we wont be buying as much of their quality produce - only a hint of sarcasm there.

Most of us, but not all, will need to be prudent to survive the next 5 years. Cut back where we can and pay down debt if and when we get the chance. More debt taken on during this time will merely postpone the inevitable hounds at the door. It aint hard, it just takes some discipline.

While we are not in a 1930s depression era economic downturn, we are going to suffer, I think, economically for as long as those folk in the 30s did, in our own way. Constraint, low or no growth and inconsistent and unsustainable upturns will be the order of the day, until that debt is discharged.

There are also other shocks to come from the heady days of economic growth during the 20 years pre 2008. Complex derivatives failures and commercial property shocks look set to come and spoil what confidence we may have gotten back.

This is all part of the economic cycle however and is nothing new and there will be opportunities to buy as others must sell cheaply to pay down debt levels.

On that last positive note, for me anyway, I will bring an end to my gloomy outlook - see you back in 6 months for an update.

Recent Share Investor Reading

- Market Correction: Excitement Building!

- Reason to be cautious on Nuplex forecast

- Cadbury Acquisition a good deal for Kraft

- Stock of the Week - Reprise : The Warehouse Group

- Bitter - Sweet Chocolate Business

- Share Investor's 2010 Stock Picks

Discuss this topic @ Share Investor Forum - Register free

Buy Stockmarket books and more

c Share Investor 2010