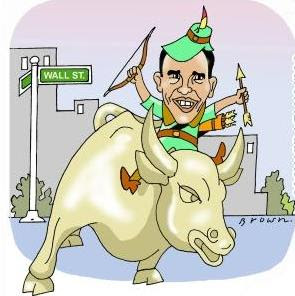

Once again global stockmarkets are rightly nervous about the so-called economic recovery in the United States, with Obama acting like Robin Hood without an arrow and rumblings of credit clampdowns in China, the DOW has lost almost 5% in one week as a result.

Once again global stockmarkets are rightly nervous about the so-called economic recovery in the United States, with Obama acting like Robin Hood without an arrow and rumblings of credit clampdowns in China, the DOW has lost almost 5% in one week as a result.

It is bloody exciting!

I was getting sick of the disconnect between the reality of a debt led "recovery" and the fantasy of investors in stockmarkets like the DOW, who have pushed that particular market up by over 40% in less than a year -incidentally that is the largest bull run since the 1929 Wall Street crash and we know what happened after that particular market "recovery".

Yep 40%, does anyone think we are doing that much better now than we were this time last year?

Not this fellow.

I last bought stocks in July and haven't felt tempted yet until The Warehouse Group [WHS.NZ] shares took a dive recently, simply because some companies are overvalued compared to 12 months ago.

The excitement is building now for me as there looks like reality could have dawned on some and they could be rushing for the exits as I am happily ready to enter the market again at a better price.

One the economic outlook, there is anecdotal evidence on my part - I tend to trust that more accurately than what economic soothsayers are being paid to say - that the economy in New Zealand, while not completely buggered, is still hanging on a knife edge between growth and recession and it appears that any growth is going to be sporadic and a long time coming.

There just isn't any money out there.

A good time to buy assets if you do have some moola and the NZX is likely to take its lead from the US market where it dropped by over 200 points last Friday.

Happy buying.

Recent Share Investor Reading

- Reason to be cautious on Nuplex forecast

- Cadbury Aquisition a good deal for Kraft

- Stock of the Week - Reprise : The Warehouse Group

- Bitter - Sweet Chocolate Business

- Share Investor's 2010 Stock Picks

- BOOK REVIEW: Warren Buffett on Business

Related Amazon Reading

The Great Depression : Delayed Recovery and Economic Change in America, 1929-1939 (Studies in Economic History and Policy : The United States in The) by Michael A. Bernstein

Buy new: $26.93 / Used from: $22.88

Usually ships in 24 hours

The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Counsel (Revised Edition) by Benjamin Graham

Buy new: $12.86 / Used from: $7.92

Usually ships in 24 hours

c Share Investor 2010